UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-K

__________________________________________________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 30, 2014

Commission File Number: 001-36347

__________________________________________________

A-MARK PRECIOUS METALS, INC.

(Exact name of registrant as specified in its charter)

__________________________________________________

|

| | |

Delaware (State of Incorporation) | | 11-2464169 (IRS Employer I.D. No.) |

Suite 230

Santa Monica, CA 90401 (Address of principal executive offices)(Zip Code)

(310) 587-1477

(Registrant’s Telephone Number, Including Area Code)

__________________________________________________

Securities registered under Section 12(b) of the Exchange Act:

|

| | |

Title of each class Common Stock, $0.01 par value | | Name of each exchange on which registered NASDAQ Global Select Market |

Securities registered under Section 12 (g) of the Exchange Act: None

__________________________________________ |

| | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | | Yes. o No. þ |

| | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | | Yes. o No. þ |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | | Yes. þ No. o |

| | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | | Yes. þ No. o |

| | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | | þ |

|

| | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act: |

Large accelerated filer o | Accelerated filer o | Non-accelerated filer þ (Do not check if a smaller reporting company) | Smaller reporting company o |

|

| | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | | Yes. o No. þ |

| | |

As of December 31, 2013, the registrant’s common stock was not publicly traded, and therefore the aggregate market value of common equity held by non-affiliates cannot be calculated as of that date. | | |

| | |

As of September 25, 2014, the registrant had 6,962,742 shares of common stock outstanding, par value $0.01 per share. | | |

A-MARK PRECIOUS METALS, INC.

2014 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Overview

A-Mark, also referred to (together with its subsidiaries) as "we", "us" and the "Company", is a full-service precious metals trading company. It is a wholesaler of gold, silver, platinum and palladium bullion and related products, including bars, wafers, grain and coins. A-Mark also-

|

| | |

• | | distributes gold and silver coins and bars from sovereign and private mints; |

| | |

• | | provides financing for the purchase of bullion and numismatics; |

| | |

• | | offers secure storage for bullion; and |

| | |

• | | offers complementary products such as consignment, customized finance and liquidity programs such as Repo accounts, and trade quotes in a variety of foreign currencies. |

A-Mark believes it has one of the largest customer bases in each of its markets and provides one of the most comprehensive offerings of products and services in the precious metals trading industry. Our customers include mints, manufacturers and fabricators, refiners, coin and bullion dealers, e-commerce retailers, banks and other financial institutions, commodity brokerage houses, industrial users of precious metals, investors and collectors. We serve customers on six continents, with over 10% of our customers being outside the United States.

A-Mark believes its businesses largely function independently of the price movement of the underlying commodities. However, factors such as global economic activity or uncertainty and inflationary trends, which affect market volatility, have the potential to impact customer demand, volumes and margins.

We conduct our operations within one business segment.

History/Spinoff from SGI

A-Mark was founded in 1965 as a small numismatics firm, which subsequently grew to include wholesale bullion trading and precious metals financing. Spectrum Group International, Inc. (SGI), then known as Greg Manning Auctions, Inc., acquired an 80% interest in A-Mark in 2005. The remaining 20% of A-Mark was acquired by Afinsa Bienes Tangibles, S.A. (Afinsa), at the time SGI's controlling shareholder. In 2012, SGI acquired from Afinsa its interest in A-Mark, as a result of which A-Mark became a wholly-owned subsidiary of SGI.

In March 2014, SGI distributed all of the shares of common stock of A-Mark to its stockholders, effecting a spinoff of A-Mark from SGI. As a result of this distribution, which we refer to as the spinoff, the Company is now a publicly traded company independent from SGI.

Over the years, A-Mark has been steadily expanding its products and services. In 1986, A-Mark became an authorized purchaser of gold and silver coins struck by the United States Mint. Similar arrangements with other sovereign mints followed, so that by the early 1990s, A-Mark had distribution relationships with all major sovereign mints offering bullion coins and bars internationally. In 2005, A-Mark launched its Collateral Finance Corporation (CFC) subsidiary for the purpose of making secured wholesale and retail loans collateralized by rare and semi-numismatic coins and bullion.

A-Mark opened an overseas office in Vienna, Austria in 2009, for the purpose of marketing its goods and services in the emerging Eastern European markets, and the office commenced full trading activity in 2012. This resulted in the expansion of A-Mark's trading hours from 12 to 17 hours a day, 5 days a week. Also in 2012, A-Mark formed, Transcontinental Depository Services, LLC (TDS), a subsidiary that provides customers with a turnkey global storage solution for their precious metals and precious metal products. In 2013, A-Mark began development of an electronic trading platform, which will allow its institutional and other large customers to execute transactions with A-Mark in precious metals and precious metal products through an automated interface. The platform is expected to be fully operational by late 2014.

Business Strategy

Through strategic relationships with its customers and suppliers and vertical integration across its markets, A-Mark seeks to grow its business volume, expand its presence in non-U.S. markets around the globe, with a principal focus on Europe and Asia, and enlarge its offering of complementary products and services. A-Mark seeks to continue its expansion by building on its strengths and what it perceives to be its competitive advantages. These include-

|

| | |

• | | vertically integrated operations that span trading, distribution, storage, financing and other consignment products and services; |

| | |

• | | an extensive and varied customer base that includes banks and other financial institutions, coin dealers, jewelers, collectors, private investors, investment advisors, manufacturers, refiners, sovereign mints and mines; |

| | |

• | | secure storage for bullion; |

| | |

• | | access to primary market makers, suppliers, refiners and government mints that provide a dependable supply of precious metals and precious metal products; |

| | |

• | | trading offices in Santa Monica, California and Vienna, Austria, giving our customers live access to our trading desk 17 hours each trading day, even when many major world commodity markets are closed; |

| | |

• | | the largest precious metals dealer network in North America; |

| | |

• | | depository relationships in major financial centers around the world; |

| | |

• | | experienced traders who effectively manage A-Mark's exposure to commodity price risk; and |

| | |

• | | a strong management team, with over 100 years of collective industry experience. |

Business Units

A-Mark operates through several business units comprising a single segment for accounting purposes, including Industrial, Coin and Bar, Trading, Finance, CFC and TDS.

Industrial. Our Industrial unit sells gold, silver, platinum and palladium to industrial and commercial users. Customers include coin fabricators such as mints, industrial manufacturers and fabricators, including electronics, and component parts companies, jewelry manufacturers and refiners. Depending on the intended usage, the metals are either investment or industrial grade and are generally in bar, wafer, plate, or grain.

Currently, orders are taken primarily telephonically, but A-Mark has developed an electronic trading platform that is in the process of being implemented and will be available to all buyers and sellers of precious metals by late 2014. Pricing is generally based on screen quotes for bullion transactions in the spot market, with two-day settlement, although special pricing and extended settlement terms are also available. For example, a customer can leave an order with A-Mark to purchase at a specified price below the current market price or an order to sell at a specified price above the current market price.

Almost all customers take physical delivery of the precious metal. Product is shipped upon receipt of payment, except where the purchase is financed under credit arrangements between A-Mark and the customer. We have relationships with precious metal depositories around the world to facilitate shipment of product from our inventory to our customers, in many cases for next day delivery. Product may either be drop shipped to the customer's location or delivered to a depository or other storage facility designated by the customer.

The Company periodically loans metals to customers on a short-term consignment basis, charging interest fees based on the value of the metals loaned. Such metal inventories are removed at the time the customers elect to price and purchase the metals, and the Company records a corresponding sale and receivable. Substantially all inventories loaned under consignment arrangements are secured by letters of credit issued by major financial institutions for the benefit of the Company or by cash.

Coin & Bar. Our Coin & Bar unit deals in over 200 different products, including gold and silver coins from around the world and gold, silver, platinum and palladium bars and ingots in a variety of weights, shapes and sizes. We currently market a limited number of such products with our proprietary “A-Mark” rounds and bars. Our customers are primarily coin and bullion dealers, although we also deal directly with banks and other financial institutions, commodity brokerage house, manufacturers, investors, investment advisors, and collectors who qualify as “eligible commercial entities” and “eligible contract participants,” as those terms are defined in the Commodity Exchange Act. Our customers range in size from large financial institutions to small local dealers.

We are an authorized distributor (or, in the case of the United States Mint, an authorized purchaser) of gold and silver coins for all of the major sovereign mints and various private mints. The sovereign mints include the United States Mint, the

Australian (Perth) Mint, the Austrian Mint, the Royal Canadian Mint, the China Mint, Banco de Mexico, the South African Mint (Rand Refinery) and the Royal Mint (United Kingdom). We purchase and take delivery of coins from the mints for resale to coin dealers and other qualified purchasers.

Our distribution and purchase agreements with the mints are non-exclusive, and may be terminated by the mints at any time, although in practice our relationship with the mints are long-standing, in some cases, as with the U.S. Mint, extending back for over 20 years. In some cases, we have developed exclusive products with sovereign and private mints for distribution through our dealer network.

Trading and Finance. Our Trading and Finance units engage in commodity hedging and borrowing and lending transactions in support of our Industrial and Coin & Bar operations.

The Trading unit hedges the commodity risk on A-Mark's inventory in order to protect A-Mark from price fluctuations in situations where settlement of a transaction is delayed or deferred. A-Mark maintains relationships with major market-makers and multiple futures brokers in order to provide a variety of alternatives for its hedging needs. Our traders employ a combination of future and spot transactions to hedge transactional exposure, and a combination of future, and forward contracts to hedge inventory exposure. Because it seeks to substantially hedge its market exposure, A-Mark believes that its business largely functions independently of the price movements in the underlying commodity. Through its hedging activities, A-Mark may also earn contango yields, in which futures price are higher than the spot prices, or backwardation yields, in which futures prices are lower than the spot prices. A-Mark also offers precious metals price quotes in a number of foreign currencies.

Our Finance unit engages in precious metals borrowing and lending transactions and other customized financial transactions with or on behalf of our customers and other counterparties. These arrangements range from simple hedging structures to complex inventory finance arrangements and forward purchase and sale structures, tailored to the needs of our customers.

CFC. Our Collateral Finance Corporation (CFC) subsidiary is a California licensed finance lender that makes and acquires commercial loans secured by numismatic and semi-numismatic coins and bullion. CFC's customers include coin and precious metal dealers, investors and collectors, most of which are active customers with A-Mark. CFC is complementary to our bullion and coin businesses, and affords customers a convenient means of financing their inventory or collections. CFC takes physical delivery of the coins or bullion collateralizing the loans, and requires loan-to-value ratios of between 50% and 80%. The loan-to-value ratio refers to the principal amount of the loan divided by the liquidation value of the collateral, as conservatively estimated by CFC. Secured loans include a combination of on-demand and short term (i.e., with terms of between three and twelve months) facilities, and bear interest at fixed rates prevailing at the time the loan is made. Other terms of the loan may be customized in accordance with the particular needs and circumstances of the borrower.

TDS. Our Transcontinental Depository Services (TDS) subsidiary provides storage solutions for precious metals and numismatic coins for financial institutions, dealers, investors and collectors worldwide. TDS contracts on behalf of our clients with independent storage facilities in the Unites States, Canada, Europe, Singapore and Hong Kong, for either fully segregated or allocated storage. We assist our clients in developing appropriate storage options for their particular requirements, and we manage the operational aspects of the storage with the third party facilities on our clients' behalf.

Market Making Activity

We act as a principal market maker, maintaining a two-way market for buying and selling precious metals. This means we both sell product to and purchase product from our customers.

Inventory

We maintain a substantial inventory of bullion and coins in order to provide our customers with selection and prompt delivery. We acquire product for our inventory in the course of our trading activities with our customers, directly from mines and refiners and from commodities brokers and dealers, privately and in transactions on established commodity exchanges. Except for certain lower of cost or market products, our inventory is “marked to market” daily for accounting and financial compliance purposes.

Sales and Marketing

We market our products and services primarily through our offices in Santa Monica, California and Vienna, Austria, our website and our dealer network, which we believe is the largest of its kind in North America. The dealer network consists of over 1,000 independent precious metal and coin companies, with whom we transact on a non-exclusive basis. The arrangements with the dealers vary, but generally the dealers acquire product from us for resale to their customers. In some instances, we deliver bullion to the dealers on a consignment basis. We also participate from time to time in trade shows and conventions, at which we promote our products and services.

As a vertically integrated precious metals concern, a key element of our marketing strategy is being able to cross-sell our products and services to customers of our different business units.

Operational Support

A-Mark maintains back office support at its offices in Santa Monica, California for processing and documenting its trading and sales activity and arranging for physical delivery and storage of product. We believe that our existing back office capacity will allow us to scale up our business activities without any appreciable increase in investment for operational support. We store our inventories of bullion with third party depositories in major financial centers around the world.

Using a third party software developer, we have created a proprietary trading program, referred to as the Metals Trading System or MTS. Through MTS we are able to input, process, track and document our trading activity, including complex hedging and similar transactions.

We have developed and are in the process of implementing an electronic trading platform for receiving and processing customer orders, with the objective of improving transactional ease and efficiency for both us and our customers. The Company has rolled-out a beta version of its new platform to certain of its customers; the platform is expected to be fully operational by late 2014. When it is fully operational we expect it will make processing small orders more economical and allow us to better allocate our resources to providing personalized service to our larger customers.

Supplier and Customer Concentrations

A-Mark buys a majority of its precious metals from a limited number of suppliers. The Company believes that numerous other suppliers are available and would provide similar products on comparable terms.

For the year ended June 30, 2014, the Company had one customer, HSBC Bank USA, comprising more than 10% of our revenues. For year ended June 30, 2013 the Company had three customers, HSBC Bank USA, Royal Canadian Mint and Johnson Matthey, each comprising more than 10% of our revenues. For year ended June 30, 2012 the Company had two customers, HSBC Bank USA and Johnson Matthey, each comprising more than 10% of our revenues. (See Note 2.) Trading Competition

A-Mark's activities cover a broad spectrum of the precious metals industry, with a concentration on the physical market. We service public, industrial and private sector consumers of precious metals which include jewelry manufacturers, industrial consumers, refiners, minting facilities, banks, brokerage houses and private investors. We face different competitors in each area and it is not uncommon for a customer and/or a supplier in one market segment to be a competitor in another. Our competitors may offer more favorable pricing or services considered to be superior to ours.

Trading Seasonality

While our precious metals trading business is not seasonal, we believe it is directly impacted by the perception of market trends and global economic activity. Historically, anticipation of increases in the rate of inflation, as well as anticipated devaluation of the U.S. dollar, has resulted in higher levels of interest in precious metals as well as higher prices for such metals.

Employees

As of June 30, 2014, we had 55 employees, with 51 located in North America, and 4 in Europe; all of these employees were considered full-time employees. We regard our relations with our employees as good.

Corporate Information

A-Mark was founded in 1965 as a New York corporation. In December 2013, the Company was reincorporated in Delaware. Our executive offices are located at 429 Santa Monica Blvd. Suite 230, Santa Monica, CA 90401. Our telephone number is (310) 587-1477, and our website is www.amark.com. Through this website, we make available, free of charge, all of our filings with the Securities and Exchange Commission (SEC), including those under the Exchange Act of 1934, as amended (Exchange Act). Such reports are made available on the same day that they are electronically filed with, or furnished to, the SEC. In addition, copies of our Code of Business Conduct and Ethics for Employees, Code of Business Conduct and Ethics for Senior Financial and Other Officers, and Code of Business Conduct and Ethics for Directors are available through this website, along with other information regarding our corporate governance policies.

Geographic Information

See Note 14 in the accompanying consolidated financial statements for information about Company's geographic operations.

ITEM 1A. RISK FACTORS

Risks Relating to Our Business Generally

Our business is heavily dependent on our credit facility.

Our business depends substantially on our ability to obtain financing for our operations. A-Mark’s borrowing facility, which we refer to as the Trading Credit Facility, provides A-Mark and CFC with the liquidity to buy and sell billions of dollars of precious metals annually. The Trading Credit Facility is a demand facility with a variable interest rate in which five lending institutions participate. A-Mark routinely uses the Trading Credit Facility to purchase metals from its suppliers and for operating cash flow purposes. Our CFC subsidiary also uses the facility to finance its lending activities.

An institutional participant in the Trading Credit facility can withdraw at any time on written notice to the Company. The loss of one or more of the lines under the Trading Credit Facility, and the failure of A-Mark to replace those lines, would reduce the financing available to the Company and could limit our ability to conduct our business, including the lending activity of our CFC subsidiary. There can be no assurance that we could procure replacement financing if all or part of the Trading Credit Facility were terminated, on commercially acceptable terms and on a timely basis, or at all.

Because the Trading Credit Facility is a demand facility, the lenders may require us to repay the indebtedness outstanding under the facility at any time. They may require repayment of the indebtedness even if we are in compliance with the financial and other covenants under the Trading Credit Facility. If the lenders were to demand repayment, we may not at the time have the financial resources to comply. As of June 30, 2014, the maximum available amount to borrow under the Trading Credit Facility was $170.0 million. Borrowings totaled $135.2 million so that the amounts available under the Trading Credit Facility was $34.8 million.

Because interest under the Trading Credit Facility is variable, we are subject to fluctuations in interest rates and we may not be able to pass along to our customers and borrowers some or any part of an increase in the interest that we are required to pay under the facility. Amounts under the Trading Credit Facility bear interest based on one month LIBOR plus a margin and vary by financial institution. The LIBOR rate was approximately 0.15% and 0.19% as of June 30, 2014 and June 30, 2013, respectively.

A change in the rates of interest charged by the lenders could adversely impact our profitability in a number of ways.

| |

• | The prices that we charge our trading customers include an interest carrying factor that reflects our cost of funds. The trading business is highly price competitive, and characterized by narrow margins. If our cost of funds increases and we cannot pass on the increase to our customers, our gross profit will decrease. |

| |

• | We borrow to finance, in part, our inventory of precious metals and coins. If our interest costs increase, we would either have to absorb the increased costs, cutting into our margins, or reduce our inventory levels, which could adversely impact our ability to service our customers. |

| |

• | In certain cases, our ability to offer customers financing for their purchases of precious metals and coins at competitive rates is an important factor the customers’ decision to transact with us. The financing we provide to our customers is funded, in part, through the borrowings under our credit facility. If our borrowing costs increase, and our customers are unwilling to finance their purchases at the higher rates, we would lose sales. |

We could suffer losses with our financing operations.

We engage in a variety of financing activities with our customers:

| |

• | Receivables from our customers with whom we trade in precious metal products are effectively short-term, non-interest bearing extensions of credit that are, in most cases, secured by the related products maintained in the Company’s possession or by a letter of credit issued on behalf of the customer. On average, these receivables are outstanding for periods of between 8 and 9 days. |

| |

• | The Company operates a financing business through CFC that makes secured loans at loan to value ratios—principal loan amount divided by the "liquidation value", as conservatively estimated by management, of the collateral—of, in most cases, 50% to 80%. These loans are both variable and fixed interest rate loans, with maturities from six to twelve months. |

| |

• | We make advances to our customers on unrefined metals secured by materials received from the customer. These advances are limited to a portion of the materials received. |

| |

• | The Company makes unsecured, short-term, non-interest bearing advances to wholesale metals dealers and government mints. |

| |

• | The Company periodically extends short-term credit through the issuance of notes receivable to approved customers at interest rates determined on a customer-by-customer basis. |

Our ability to minimize losses on the credit that we extend to our customers depends on a variety of factors, including:

| |

• | our loan underwriting and other credit policies and controls designed to assure repayment, which may prove inadequate to prevent losses; |

| |

• | our ability to sell collateral upon customer defaults for amounts sufficient to offset credit losses, which can be affected by a number of factors outside of our control, including (i) changes in economic conditions, (ii) increases in market rates of interest and (iii) changes in the condition or value of the collateral; and |

| |

• | the reserves we establish for loan losses, which may prove inadequate. |

Our business is dependent on a concentrated customer base.

One of A-Mark's key assets is its customer base. This customer base provides deep distribution of product and makes A-Mark a desirable trading partner for precious metals product manufacturers, including sovereign mints seeking to distribute precious metals coinage or large refiners seeking to sell large volumes of physical precious metals. A-Mark's top three customers represented 25.9%, 7.9% and 6.2%, respectively, of revenues for the year ended June 30, 2014. For the year ended June 30, 2013, A-Mark's top three customers represented 11.4%, 11.2% and 10.7%, respectively of our revenues. If our relationships with these customers deteriorated, or if we were to lose one or more of these customers, our business would be materially adversely affected.

The loss of a government purchaser/distributorship arrangement could materially adversely affect our business.

A-Mark’s business is heavily dependent on its purchaser/distributorship arrangements with various governmental mints. Our ability to offer numismatic coins and bars to our customers on a competitive basis is based on the ability to purchase products directly from a government source. The arrangements with the governmental mints may be discontinued by them at any time. The loss of an authorized purchaser/distributor relationship, including with the U.S. Mint could have a materially adverse effect on our business.

The materials held by A-Mark are subject to loss, damage, theft or restriction on access.

A-Mark has significant quantities of high-value precious metals on site, at third-party depositories and in transit. There is a risk that part or all of the gold and other precious metals held by A-Mark, whether on its own behalf or on behalf of its customers, could be lost, damaged or stolen. In addition, access to A-Mark’s gold could be restricted by natural events (such as an earthquake) or human actions (such as a terrorist attack). Although we maintain insurance on terms and conditions that we consider appropriate, we may not have adequate sources of recovery if our precious metals inventory is lost, damaged, stolen or destroyed, and recovery may be limited. Among other things, our insurance policies exclude coverage in the event of loss as a result of terrorist attacks or civil unrest.

Our business is subject to the risk of fraud and counterfeiting.

The precious metals (particularly bullion) business is exposed to the risk of loss as a result of “materials fraud” in its various forms. We seek to minimize our exposure to this type of fraud through a number of means, including third-party authentication and verification, reliance on our internal experts and the establishment of procedures designed to detect fraud. However, there can be no assurance that we will be successful in preventing or identifying this type of fraud, or in obtaining redress in the event such fraud is detected.

Our business is influenced by political conditions and world events.

The precious metals business is especially subject to global political conditions and world events. Precious metals are viewed by some as a secure financial investment in times of political upheaval or unrest, particularly in developing economies, which may drive up pricing. The volatility of the commodity prices for precious metals is also likely to increase in politically uncertain times. Conversely, during periods of relative international calm precious metal volatility is likely to decrease, along with demand, and the prices of precious metals may retreat. Because our business is dependent on the volatility and pricing of precious metals, we are likely to be influenced by world events more than businesses in other economic sectors.

We have significant operations outside the United States.

We derive over 10% of our revenues from business outside the United States, including from customers in developing countries. Business operations outside the U.S. are subject to political, economic and other risks inherent in operating in foreign countries. These include risks of general applicability, such as the need to comply with multiple regulatory regimes; trade protection measures and import or export licensing requirements; and fluctuations in equity, revenues and profits due to changes in foreign

currency exchange rates. Currently, we do not conduct substantial business with customers in developing countries. However, if our business in these areas of the world were to increase, we would also face risks that are particular to developing countries, including the difficulty of enforcing agreements, collecting receivables; protecting inventory and other assets through foreign legal systems; limitations on the repatriation of earnings; currency devaluation and manipulation of exchange rates; and high levels of inflation.

We try to manage these risks by monitoring current and anticipated political, economic, legal and regulatory developments in the Company’s outside the United States in which we operate or have customers and adjusting operations as appropriate, but there can be no assurance that the measures we adopt will be successful in protecting the Company’s business interests.

We are dependent on our key management personnel and our trading experts.

Our performance is dependent on our senior management and certain other key employees. We have employment agreements with Greg Roberts, our CEO, and with three other employees, our president, a senior vice president and our chief operating officer. These employment agreements all expire at the end of fiscal 2016, other than the agreement with our president, which expires at the end of fiscal 2015. These and other employees have expertise in the trading markets, have industry-wide reputations, and perform critical functions for our business. We cannot offer assurance that we will be able to negotiate acceptable terms for the renewal of the employment agreements or otherwise retain our key employees. Also, there is significant competition for skilled precious metals traders and other industry professionals. The loss of our current key officers and employees, without the ability to replace them, would materially and adversely affect our business.

We are focused on growing our business, but there is no assurance that we will be successful.

We expect to grow both organically and through opportunistic acquisitions. We have devoted considerable time, resources and efforts over the past few years to our growth strategy. These efforts have placed, and are expected to continue to place, demands on our management and other personnel and resources, and have required, and will continue to require, timely and continued investment in facilities, personnel and financial and management systems and controls. We may not be successful in implementing our growth initiatives, which could adversely affect our business.

Liquidity constraints may limit our ability to grow our business.

To accomplish our growth strategy, we will require adequate sources of liquidity to fund both our existing business and our expansion activity. Currently, our sources of liquidity are the cash that we generate from operations and our borrowing availability under the Trading Credit Facility. There can be no assurance that these sources will be adequate to support the growth that we are hoping to achieve or that additional sources of financing for this purpose, in the form of additional debt or equity financing, will be available to us, on satisfactory terms or at all. Also, the Trading Credit Facility contains, and any future debt financing is likely to contain, various financial and other restrictive covenants. The need to comply with these covenants may limit our ability to implement our growth initiatives.

We expect to grow in part through acquisitions, but an acquisition strategy entails risks.

We expect to grow in part through acquisitions. We will consider potential acquisitions of varying sizes and may, on a selective basis, pursue acquisitions or consolidation opportunities involving other public companies or privately held companies. However, it is possible that we will not realize the expected benefits from our acquisitions or that our existing operations will be adversely affected as a result of acquisitions. Acquisitions entails certain risks, including: unrecorded liabilities of acquired companies that we fail to discover during our due diligence investigations; difficulty in assimilating the operations and personnel of the acquired company within our existing operations or in maintaining uniform standards; loss of key employees of the acquired company; and strains on management and other personnel time and resources both to research and integrate acquisitions.

We expect to pay for future acquisitions using cash, capital stock, notes and/or assumption of indebtedness. To the extent that our existing sources of cash are not sufficient to fund future acquisitions, we will require additional debt or equity financing and, consequently, our indebtedness may increase or shareholders may be diluted as we implement our growth strategy.

We are subject to government regulations, and the cost of compliance could increase.

There are various federal, state, local and foreign laws, ordinances and regulations that affect our trading business. For example, we are required to comply with a variety of anti-money laundering and know-your customer rules in response to the USA Patriot Act.

The SEC has promulgated final rules mandated by the Dodd-Frank Act regarding disclosure, on an annual basis, of the use of tin, tantalum, tungsten and gold, known as conflict minerals, in products manufactured by public companies. These new rules require due diligence to determine whether such minerals originated from the Democratic Republic of Congo (the DRC) or an adjoining country and whether such minerals helped finance the armed conflict in the DRC.

The Company has concluded that it is not currently subject to the conflict minerals rules because it is not a manufacturer of conflict minerals under the definitions set forth in the rules. Depending on developments in the Company’s business, it could become subject to the rules at some point in the future. In that event, there will be costs associated with complying with these disclosure requirements, including costs to determine the origin of gold used in our products. In addition, the implementation of these rules could adversely affect the sourcing, supply and pricing of gold used in our products. Also, we may face disqualification as a supplier for customers and reputational challenges if the due diligence procedures we implement do not enable us to verify the origins for the gold used in our products or to determine that the gold is conflict free.

CFC operates under a California Finance Lenders License issued by the California Department of Corporations. CFC is required to submit a finance lender law annual report to the state which summarizes certain loan portfolio and financial information regarding CFC. The Department of Corporations may audit the books and records of CFC to determine whether CFC is in compliance with the terms of its lending license.

There can be no assurance that the regulation of our trading and lending businesses will not increase or that compliance with the applicable regulations will not become more costly or require us to modify our business practices.

We operate in a highly competitive industry.

The business of buying and selling precious metals is global and highly competitive. The Company competes with precious metals trading firms and banks throughout North America, Europe and elsewhere in the world, some of whom have greater financial and other resources, and greater name recognition, than the Company. We believe that, as a full service firm devoted exclusively to precious metals trading, we offer pricing, product availability, execution, financing alternatives and storage options that are attractive to our customers and allow us to compete effectively. We also believe that our purchaser/distributorship arrangements with various governmental mints give us a competitive advantage in our coin distribution business. However, given the global reach of the precious metals trading business, the absence of intellectual property protections and the availability of numerous, evolving platforms for trading in precious metals, we cannot assure you that A-Mark will be able to continue to compete successfully or that future developments in the industry will not create additional competitive challenges.

We rely extensively on computer systems to execute trades and process transactions, and we could suffer substantial damages if the operation of these systems were interrupted.

We rely on our computer and communications hardware and software systems to execute a large volume of trading transactions each year. It is therefore critical that we maintain uninterrupted operation of these systems, and we have invested considerable resources to protect our systems from physical compromise and security breaches and to maintain backup and redundancy. Nevertheless, our systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, including breaches of our transaction processing or other systems, catastrophic events such as fires, tornadoes and hurricanes, and usage errors by our employees. If our systems are breached, damaged or cease to function properly, we may have to make a significant investment to fix or replace them, we may suffer interruptions in our ability to provide quotations or trading services in the interim, and we may face costly litigation.

We have developed and are in the process of implementing an electronic trading platform that will allow our customers to place orders with us using a computerized interface. The trading platform should be fully operational by late 2014. While we believe that this platform will offer many advantages to us and our customers in terms of efficiency and ease of operation, there can be no assurance that we will be successful in implementing this platform in a manner that will be attractive to our customers or at all. Also, as in any new systems, we may experience operational difficulties with the platform in the early stages of its use, which could adversely affect relationships with our customers.

If our customer data were breached, we could suffer damages and loss of reputation.

By the nature of our business, we maintain significant amounts of customer data on our systems. Moreover, certain third party providers have access to confidential data concerning the Company in the ordinary course of their business relationships with the Company. In recent years, various companies, including companies that are significantly larger than us, have reported breaches of their computer systems that have resulted in the compromise of customer data. Any significant compromise or breach of customer or company data held or maintained by either the Company or our third party providers could significantly damage our reputation and result in costs, lost trades, fines and lawsuits. The regulatory environment related to information security and privacy is increasingly rigorous, with new and constantly changing requirements applicable to our business, and compliance with those requirements could result in additional costs. There is no guarantee that the procedures that we have implemented to protect against unauthorized access to secured data are adequate to safeguard against all data security breaches.

Risks Relating to Commodities

A-Mark’s business is heavily influenced by volatility in commodities prices.

A primary driver of A-Mark’s profitability is volatility in commodities prices, which lead to wider bid and ask spreads. Among the factors that can impact the price of precious metals are supply and demand of precious metals; political, economic, and global financial events; movement of the U.S. dollar versus other currencies; and the activity of large speculators such as hedge funds. If commodity prices were to stagnate, there would likely be a reduction in trading activity, resulting in less demand for the services A-Mark provides, which could materially adversely affect our business, liquidity and results of operations.

Our business is exposed to commodity price risks, and our hedging activity to protect our inventory is subject to risks of default by our counterparties.

A-Mark’s precious metals inventories are subject to market value changes created by change in the underlying commodity price, as well as supply and demand of the individual products the Company trades. In addition, open sales and purchase commitments are subject to changes in value between the date the purchase or sale is fixed (the trade date) and the date metal is delivered or received (the settlement date). A-Mark seeks to minimize the effect of price changes of the underlying commodity through the use of financial derivative instruments, such as forward and futures contracts. A-Mark’s policy is to remain substantially hedged as to its inventory position and its individual sale and purchase commitments. A-Mark’s management monitors its hedged exposure daily. However, there can be no assurance that these hedging activities will be adequate to protect the Company against commodity price risks associated with A-Mark’s business activities.

Furthermore, even if we are fully hedged as to any given position, there is the risk of default by our counterparties to the hedge. Any such default could have a material adverse effect on our financial position and results of operations.

Increased commodity pricing could limit the inventory that we are able to carry.

We maintain a large and varied inventory of precious metal products, including bullion and coins, in order to support our trading activities and provide our customers with superior service. The amount of inventory that we are able to carry is constrained by the borrowing limitations and working capital covenants under our credit facility. If commodity prices were to rise substantially, and we were unable to modify the terms of our credit facility to compensate for the increase, the quantity of product that we could finance, and hence maintain, in our inventory would fall. This would likely have a material adverse effect on our operations.

The Dodd-Frank Act could adversely impact our use of derivative instruments to hedge precious metal prices and may have other adverse effects on our business.

On July 21, 2010, President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act, which requires the Commodity Futures Trading Commission to promulgate rules and regulations implementing the new legislation, including with respect to derivative contracts on commodities. This legislation and any implementing regulations could significantly increase the cost of some commodity derivative contracts (including through requirements to post collateral, which could adversely affect our available liquidity), materially alter the terms of some commodity derivative contracts, reduce the availability of some derivatives to protect against risks, reduce our ability to monetize or restructure our existing commodity derivative contracts and potentially increase our exposure to less creditworthy counterparties. If we reduce our use of derivatives as a result of the Dodd-Frank legislation and regulations, we would be exposed to inventory and other risks associated with fluctuations in commodity prices. Also, if the Dodd-Frank legislation and regulations result in less volatility in commodity prices, our revenues could be adversely affected.

We rely on the efficient functioning of commodity exchanges around the world, and disruptions on these exchanges could adversely affect our business.

The Company buys and sells precious metals contracts on commodity exchanges around the world, both in support of its customer operations and to hedge its inventory and transactional exposure against fluctuations in commodity prices. The Company’s ability to engage in these activities would be compromised if the exchanges on which the Company trades or any of their clearinghouses were to discontinue operations or to experience disruptions in trading, due to computer problems, unsettled markets or other factors. The Company may also experience risk of loss if futures commission merchants or commodity brokers with whom the Company deals were to become insolvent or bankrupt.

Risks Relating to Our Common Stock

Public company costs will increase our expenses and administrative burden, in particular in order to bring our Company into compliance with certain provisions of the Sarbanes Oxley Act of 2002.

As a newly public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. These increased costs and expenses may arise from various factors, including financial reporting costs associated with complying with federal securities laws (including compliance with the Sarbanes-Oxley Act of 2002).

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, and related regulations implemented by the SEC and NASDAQ have created uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. We are currently evaluating and monitoring developments with respect to new and proposed rules and cannot predict or estimate the amount of the additional costs we may incur or the timing of such costs. Applicable laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased selling, general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us and our business may be harmed.

We have identified a material weakness in our internal control over financial reporting, and our business and stock price may be adversely affected if we do not adequately address this weakness or if we have other material weaknesses or significant deficiencies in our internal control over financial reporting.

The Company has in the past operated with inadequate and insufficient accounting and finance resources to ensure timely and reliable financial reporting. As a result of this material weakness, the Company's management has concluded that, as of June 30, 2013 and March 31, 2014, its internal control over financial reporting was not effective. To remediate this material weakness, during the fourth quarter of fiscal 2014, we:

| |

• | Determined the appropriate complement of corporate accounting and finance personnel required to ensure timely and reliable financial reporting; |

| |

• | Hired the requisite additional personnel with public company accounting and reporting experience; and |

| |

• | Organized and designed our internal review and evaluation process to include more formal management oversight of the methods and review procedures utilized and the conclusions reached, including for purposes of evaluating and ensuring the sufficiency of accounting resources. |

Management believes that these steps have remediated the material weakness we identified. However, our first assessment of the effectiveness of our internal control over financial reporting will not take place until as of the year ending June 30, 2015, and we can give no assurance that the measures we have taken have remediated the material weakness that we identified or that any additional material weaknesses will not arise in the future. We will continue to monitor the effectiveness of these and other processes, procedures and controls and will make any further changes management determines appropriate.

The existence of one or more other material weaknesses or significant deficiencies could result in errors in our financial statements, and substantial costs and resources may be required to rectify any internal control deficiencies. If we cannot produce reliable financial reports, investors could lose confidence in our reported financial information, the market price of our stock could decline significantly, we may be unable to obtain additional financing to operate and expand our business, and our business and financial condition could be adversely affected.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of Sarbanes-Oxley could have a material adverse effect on our business.

As a public company, we will be required to document and test our internal control over financial reporting in order to satisfy the requirements of Section 404 of Sarbanes-Oxley, which will require annual management assessments of the effectiveness of our internal control over financial reporting, beginning with our Annual Report on Form 10-K for the year ending June 30, 2015.

Accordingly, we will be required to implement standalone policies and procedures to comply with the requirements of Section 404. Also, unless we are not categorized as an accelerated filer, which would be the case if the market value of our common stock held by non-affiliates as of our most recently completed second quarter is less than $75 million, we will also be required to obtain a report by our independent registered public accounting firm that addresses the effectiveness of internal control over financial reporting.

During the course of our testing of our internal controls and procedures, we may identify deficiencies which we may not be able to remediate in time to meet our deadline for compliance with Section 404. Testing and maintaining internal controls can divert our management’s attention from other matters that are also important to the operation of our business. We also expect that the imposition of these regulations will increase our legal and financial compliance costs and make some activities more difficult, time consuming and costly. We may not be able to conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. If we are unable to conclude that we have effective internal controls over financial reporting, then investors could lose confidence in our reported financial information, which would likely have a negative effect on the trading price of our common stock. In addition, if we do not maintain effective internal controls, we may not be able to accurately report our financial information on a timely basis, which could harm the trading price of our common stock, impair our ability to raise additional capital, or jeopardize our continued listing on the NASDAQ Global Select Market or any other stock exchange on which common stock may be listed. We are in the process of enhancing our internal controls over financial reporting but there can be no assurance that our controls will function as intended.

We may not be able to or may choose not to pay dividends.

We cannot at this time predict whether our board will institute a policy of regular dividends. Further, our current credit arrangements contain restrictions on the payment of dividends. As a result, shareholders may not receive any return on an investment in our capital stock in the form of dividends, and may only obtain an economic benefit from the common stock only after an increase in its trading price and only by selling the common stock.

Provisions in our Certificate of Incorporation and Bylaws and of Delaware law may prevent or delay an acquisition of the Company, which could decrease the trading price of our common stock.

Our amended and restated certificate of incorporation and amended and restated bylaws and Delaware law contain certain anti-takeover provisions that could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from attempting to acquire, control of the Company without negotiating with our board of directors. Such provisions could limit the price that certain investors might be willing to pay in the future for the Company’s securities. Certain of such provisions allow the Company to issue preferred stock with rights senior to those of the common stock, impose various procedural and other requirements which could make it more difficult for shareholders to effect certain corporate actions and set forth rules regarding how shareholders may present proposals or nominate directors for election at shareholder meetings.

We believe these provisions protect our shareholders from coercive or otherwise unfair takeover tactics by requiring potential acquirers to negotiate with our board and by providing our board with more time to assess any acquisition proposal. However, these provisions apply even if an acquisition offer may be considered beneficial by some shareholders and could delay or prevent an acquisition that our board determines is not in the best interests of our company and our shareholders. Accordingly, in the event that our board determines that a potential business combination transaction is not in the best interests of our Company and our shareholders, but certain shareholders believe that such a transaction would be beneficial to the Company and its shareholders, such shareholders may elect to sell their shares in the Company and the trading price of our common stock could decrease.

Your percentage ownership in the Company could be diluted in the future.

Your percentage ownership in A-Mark potentially will be diluted in the future because of additional equity awards that we expect will be granted to our directors, officers and employees in the future. We have established an equity incentive plan that provides for the grant of common stock-based equity awards to our directors, officers and other employees. In addition, we may issue equity in order to raise capital or in connection with future acquisitions and strategic investments, which would dilute your percentage ownership.

Our board and management beneficially own a sizeable percentage of our common stock and therefore have the ability to exert substantial influence as shareholders.

Members of our board and management beneficially own over 45% of our outstanding common stock. Acting together in their capacity as shareholders, the board members and management could exert substantial influence over matters on which a shareholder vote is required, such as the approval of business combination transactions. Also because of the size of their beneficial ownership, the board members and management may be in a position effectively to determine the outcome of the election of directors and the vote on shareholder proposals. The concentration of beneficial ownership in the hands of our board and management may therefore limit the ability of our public shareholders to influence the affairs of the Company.

If the Company's spinoff from SGI is determined to be taxable for U.S. federal income tax purposes, our shareholders could incur significant U.S. federal income tax liabilities.

In connection with the spinoff, SGI received the written opinion of Kramer Levin Naftalis & Frankel LLP (Kramer Levin)to the effect that the spinoff qualified as a tax-free transaction under Section 355 of the Internal Revenue Code, and that for U.S. federal income tax purposes (i) no gain or loss was recognized by SGI upon the distribution of our common stock in the spinoff, and (ii) no gain or loss was recognized by, and no amount was included in the income of, holders of SGI common stock upon the receipt of shares of our common stock in the spinoff. The opinion of tax counsel is not binding on the Internal Revenue Service or the courts, and there is no assurance that the IRS or a court will not take a contrary position. In addition, the opinion of Kramer Levin relied on certain representations and covenants delivered by SGI and us. If, notwithstanding the conclusions included in the opinion, it is ultimately determined that the distribution does not qualify as tax-free for U.S. federal income tax purposes, each SGI shareholder that is subject to U.S. federal income tax and that received shares of our common stock in the distribution could be treated as receiving a taxable distribution in an amount equal to the fair market value of such shares. In addition, if the distribution were not to qualify as tax-free for U.S. federal income tax purposes, then SGI would recognize gain in an amount equal to the excess of the fair market value of our common stock distributed to SGI shareholders on the date of the distribution over SGI’s tax basis in such shares. Also, we could have an indemnification obligation to SGI related to its tax liability.

We might not be able to engage in desirable strategic transactions and equity issuances because of restrictions relating to U.S. federal income tax requirements for tax-free distributions.

Our ability to engage in significant equity transactions is restricted in order to preserve for U.S. federal income tax purposes the tax-free nature of the distribution by SGI. Even if the distribution otherwise qualifies for tax-free treatment under Section 355 of the Internal Revenue Code, it may be taxable to SGI if 50% or more, by vote or value, of shares of our common stock or SGI’s common stock are acquired or issued as part of a plan or series of related transactions that includes the distribution. For this purpose, any acquisitions or issuances of SGI’s common stock within two years before the distribution, and any acquisitions or issuances of our or SGI’s common stock within two years after the distribution, generally are presumed to be part of such a plan, although we or SGI may be able to rebut that presumption. If an acquisition or issuance of shares of our common stock or SGI’s common stock triggers the application of Section 355(e) of the Code, SGI would recognize a taxable gain to the extent the fair market value of our common stock immediately prior to the distribution exceeds SGI’s tax basis in our common stock at such time.

Under the tax separation agreement, there are restrictions on our ability to take actions that could cause the distribution to fail to qualify for favorable treatment under the Internal Revenue Code. These restrictions may prevent us from entering into transactions which might be advantageous to us or our shareholders.

There can be no assurance that SGI will not enter insolvency proceedings.

There is no assurance that, in the future, SGI will not be subject to bankruptcy or other insolvency proceedings. If that were the case, SGI creditors may allege that SGI was insolvent at the time of the distribution, or was rendered insolvent as a result of the distribution, such that the distribution constituted a fraudulent conveyance, and such creditors could seek to recover the A-Mark shares distributed in the spinoff or their value.

As disclosed in SGI’s Annual Report on Form 10-K, in May 2006, Spanish judicial authorities shut down the operations of Afinsa and began an investigation related to alleged criminal wrongdoing, including money laundering, fraud, tax evasion and criminal insolvency. The Spanish criminal investigation initially focused on Afinsa and certain of its executives and was later expanded to include several former officers and directors of SGI and Central de Compras, including Greg Manning, a former chief executive officer of SGI. The allegations against Afinsa and the certain named individuals relate to the central claim that Afinsa's business operations constituted a fraudulent “Ponzi scheme,” whereby funds received from later investors were used to pay interest to earlier investors, and that the stamps that were the subject of the investment contracts were highly overvalued. Spanish authorities have alleged that Mr. Manning knew Afinsa's business, and aided and abetted in its activity by, among other things, causing SGI to supply allegedly overvalued stamps to Afinsa.

The Company understands that under Spanish law, if any of the former officers or directors of SGI or its subsidiary were ultimately found guilty, then, under the principle of secondary civil liability, SGI could be held liable for certain associated damages. In July 2013, the Spanish judicial authorities determined to bring formal charges of indictment against certain persons formerly associated with Afinsa and SGI, including Mr. Manning. The charges include a civil demand for substantial monetary damages. On October 7, 2013, the Spanish court issued an order naming SGI as a party, on a secondary civil liability basis, to the proceedings. We cannot predict the outcome of the proceedings, and we cannot assure you that the solvency of SGI could not be deemed to be affected by the proceedings.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our headquarters is located in Santa Monica, our trading desk operations are conducted from facilities in Santa Monica, California and Vienna, Austria. Below is a table summarizing the properties we occupied during the year ended June 30, 2014.

|

| | | | | |

Location | | Square Footage | | Lease Term/Expiration |

Santa Monica, California | | 7,100 |

| | April 2017 |

Vienna, Austria | | 2,100 |

| | September 2016 |

ITEM 3. LEGAL PROCEEDINGS

We are party to various legal proceedings arising in the ordinary course of its business. Based on the information currently available, we are not currently a party to any legal proceeding that management believes would have a material adverse effect on our consolidated financial position, cash flows or operations.

ITEM 4. MINE SAFETY DISCLOSURES

None.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

SGI effected the spinoff of A-Mark on March 14, 2014. On March 17, 2014, A-Mark’s shares of common stock commenced trading on the NASDAQ Global Select Market under the symbol "AMRK."

As of September 25, 2014, there were 703 registered stockholders of record of our common stock and the last reported sale price of our stock as reported by the NASDAQ Global Select Market was $11.43.

The following table sets forth the range of high and low closing prices for our common stock for each full quarterly period during fiscal 2014, as reported by the NASDAQ Global Select Market. These quotations below reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

| | | | | | | |

| 2014 |

Quarter | High | | Low |

First | N/A |

| | N/A |

|

Second | N/A |

| | N/A |

|

Third | N/A |

| | N/A |

|

Fourth | $ | 13.08 |

| | $ | 10.87 |

|

Issuer Purchases of Equity Securities

The following is a summary of our shares repurchased during the fourth quarter of fiscal 2014:

|

| | | | | | | | | | | | | |

| | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of a Publicized Announced Plan | | Maximum Number of Shares that May Yet be Repurchased Under the Plan |

April 2014 | | — |

| | $ | — |

| | — |

| | — |

|

May 2014 | | — |

| | — |

| | — |

| | — |

|

June 2014(1) | | 379,033 |

| | 5.80 |

| | 379,033 |

| | — |

|

Total | | 379,033 |

| | $ | 5.80 |

| | 379,033 |

| | — |

|

|

| | | |

_________________________________ |

(1) | | Represents the purchase of A-Mark common stock from Afinsa and its subsidiary pursuant to a Purchase Agreement, dated February 26, 2014, as amended. | |

Stock Price Performance

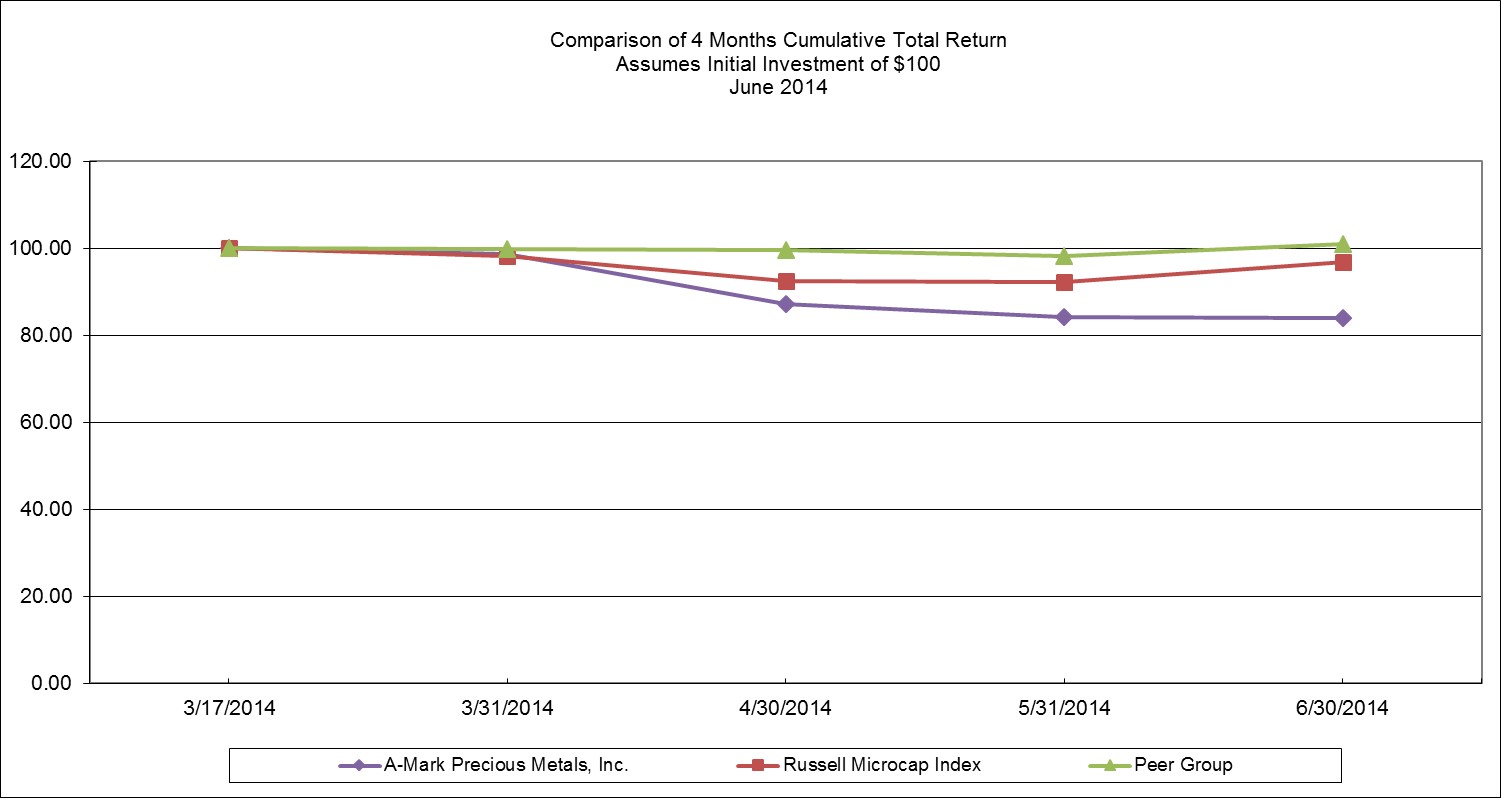

The following graph compares cumulative total shareholder return on our capital stock relative to the cumulative total return of the Russell Microcap Index and of companies in our peer group, which was determined by us. The cumulative total return listed below assumed an initial investment of $100 and reinvestments of dividends, from the Company's first trading date (i.e., March 17, 2014). The companies included in our peer group are: (1) GAIN Capital Holdings, Inc.; (2) INTL FCStone Inc.; and (3) IG Group Holdings plc.

Dividend Policy

During the years ended June 30, 2014 and 2013, the Company paid cash dividends to its Former Parent, SGI, of $10.0 million and $15.0 million, respectively. There were no dividends paid for the year ended June 30, 2012.

We have as yet made no determination regarding our policy on the payment of dividends following the spinoff. We expect that our board or directors will make a determination on the payment of regular dividends based upon our financial performance, need for operating liquidity, applicable covenants in our financing agreements, business development and expansion programs, market expectations and other relevant factors.

A-Mark’s credit facility has certain restrictive financial covenants that require A-Mark to maintain a minimum tangible net worth (as defined) of $25.0 million. Our ability to pay dividends, if our board determines to do so, could be limited as a result of this covenant.

Equity Compensation Plan Information

The following table provides information as of June 30, 2014, with respect to the shares of our common stock that may be issued under existing equity compensation plans.

|

| | | | | | | | | | | | | |

Plan category | | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | (b) Weighted average exercise price of outstanding options, warrants and rights | | | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

Equity compensation plans approved by security holders | | 346,451 |

| (1) | | $ | 7.97 |

| (2) | | 625,000 |

| (3) |

Equity compensation plans not approved by security holders(3) | | — |

| | | — |

| | | — |

| |

Total | | 346,451 |

| | | $ | 7.97 |

| | | 625,000 |

| |

| | | | | | | | | |

|

| | | |

_________________________________ |

(1) | | Consists of stock options and restricted stock units granted by A-Mark to replace outstanding SGI stock options and restricted stock units in connection with the spinoff. The former SGI equity awards had been granted by SGI under its 2012 Stock Award and Incentive Plan (2012 Plan) and its 1997 Stock Incentive Plan, as amended (1997 Plan). The terms of the 2012 Plan and 1997 Plan governing equity awards generally apply to the replacement awards granted by A-Mark, but A-Mark was not and is not authorized to grant equity awards under those Plans other than the equity awards that directly replaced the former SGI equity awards. | |

| | | |

(2) | | Weighted average exercise price is calculated including RSUs, which for this purpose are treated as having an exercise price of zero. If calculated solely for options and stock appreciation rights that have an exercise price, the weighted average exercise price of outstanding options, warrants and rights at June 30, 2014 was $11.51. | |

| | | |

(3) | | These shares are available for future issuance under A-Mark's 2014 Stock Award and Incentive Plan (2014 Plan). All 2014 Plan shares are available for awards of stock options, stock appreciation rights, restricted stock units, restricted stock and other "full-value" awards. | |

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial and operating data are derived from our consolidated financial statements and should be read in conjunction with "Management’s Discussion and Analysis of Financial Condition and Results of Operations", included in Item 7 and our Consolidated Financial Statements included in Item 8. Our consolidated financial information may not be indicative of our future performance and does not necessarily reflect what our financial position and results of operations would have been had we operated as a publicly traded company independent from SGI during the periods presented. |

| | | | | | | | | | | | | | | | | | | | |

Amounts in thousands, except per share data |

Years Ended June 30, | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Consolidated Statements of Income Data |

| | | | | | | | | | |

Net revenues | | $ | 5,979,354 |

| | $ | 7,247,717 |

| | $ | 7,782,340 |

| | $ | 6,988,876 |

| | $ | 5,858,854 |

|

Net income | | $ | 8,259 |

| | $ | 12,514 |

| | $ | 10,574 |

| | $ | 12,660 |

| | $ | 6,573 |

|

Basic income per share (1) | | $ | 1.10 |

| | $ | 1.61 |

| | $ | 1.29 |

| | $ | 1.56 |

| | $ | 0.82 |

|

Diluted net income per share (1) | | $ | 1.09 |

| | $ | 1.59 |

| | $ | 1.29 |

| | $ | 1.55 |

| | $ | 0.82 |

|

| | | | | | | | | | |

Consolidated Balance Sheets Data (at end of fiscal year, June 30) |

Total Assets | | $ | 305,138 |

| | $ | 309,608 |

| | $ | 309,115 |

| | $ | 285,469 |

| | $ | 181,367 |

|

Lines of Credit | | $ | 135,200 |

| | $ | 95,000 |

| | $ | 91,000 |

| | $ | 129,500 |

| | $ | 45,200 |

|

Total current liabilities | | $ | 255,649 |

| | $ | 255,802 |

| | $ | 253,211 |

| | $ | 240,604 |

| | $ | 145,643 |

|

|

| | | |

_________________________________ |

(1) | | Basic and diluted income per share was based on historical SGI basic and fully diluted share figures through March 14, 2014, the distribution date. Amounts shown were retroactively adjusted to give effect for the share distribution in connection with the spinoff, on the basis of one share of A-Mark stock issued for every four shares of SGI stock held through the distribution date. Thereafter, basic and diluted income per share was based on the Company's historical basic and fully diluted share figures. | |

| | | |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Statement Pursuant to the Private Securities Litigation Reform Act of 1995

This Annual Report on Form 10-K ("Form 10-K") contains statements that are considered forward-looking statements. Forward-looking statements give the Company's current expectations and forecasts of future events. All statements other than statements of current or historical fact contained in this quarterly report, including statements regarding the Company's future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “plan,” and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. These statements are based on the Company's current plans, and the Company's actual future activities and results of operations may be materially different from those set forth in the forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the statements made. Any or all of the forward-looking statements in this quarterly report may turn out to be inaccurate. The Company has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of

operations, business strategy and financial needs. The forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and assumptions. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events occurring after the date hereof. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained in this Form 10-K.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and notes contained elsewhere in this Form 10-K. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in these forward-looking statements. Factors that could cause or contribute to these differences include those factors discussed below and elsewhere in this Annual Report, particularly in “Risk Factors.” Introduction

Management's discussion and analysis of financial condition and results of operations is provided as a supplement to the accompanying consolidated financial statements and related notes to help provide an understanding of our results of operations and financial condition. Our discussion is organized as follows:

| |

• | Executive overview. This section provides a general description of our business, as well as significant transactions and events that we believe are important in understanding the results of operations. |

| |