March 18, 2011

A-Mark Precious Metals, Inc.

429 Santa Monica Blvd.

Suite 230

Santa Monica, CA 90401

Attention: Mr. Thor Gjerdrum

Ladies and Gentlemen:

ABN AMRO Capital USA LLC (the "Lender") is pleased to inform you that the Lender has established for you, A-Mark Precious Metals, Inc., a California corporation (the "Company"), a $25,000,000 million uncommitted line of credit available for loans and letters of credit.

Each loan, letter of credit or other extension of credit shall be used only for the purpose of financing precious metals and coins inventory and trade accounts receivable arising from sale thereof to unaffiliated companies or financing the Company's loans to its subsidiary, Collateral Finance Corporation, unless otherwise agreed by the Lender.

All loans shall be payable on demand but in any event not later than 90 days after the date made, unless otherwise agreed in writing by the Lender. All letters of credit shall have expiration dates not later than 60 days after the issuance date, unless otherwise agreed by the Lender (in writing or by issuance of such letter of credit), and the Company shall be obligated on demand by the Lender to deposit cash collateral with the Lender in an amount equal to the maximum face amount of all outstanding letters of credit. The Lender shall in its sole discretion determine whether to issue any letter of credit itself or to arrange for confirmation or issuance of any letter of credit by another bank or financial institution, including, without limitation, affiliated banks.

The Company's obligations to the Lender will be secured by a perfected security interest in all personal property and fixtures of the Company granted to the Collateral Agent on behalf of the Lender. All other financial institutions which extend credit to the Company and which have security interests in personal property of the Company will be joined to the Amended and Restated Intercreditor Agreement, dated as of November 30, 1999, among the Company, BNP Paribas, as successor to Fortis Capital Corp., RB International Finance (USA) LLC f/k/a RZB Finance LLC, Natixis New York Branch, ABN AMRO Bank N.V., as successor by merger to Fortis Bank (Nederland) N.V., and Brown Brothers Harriman & Co., as Collateral Agent (as amended, modified, supplemented or replaced from time to time, the "Intercreditor Agreement") and the Amended and Restated Collateral Agency Agreement, dated as of November 30, 1999, among the Company, BNP Paribas, as successor to Fortis Capital Corp., RB International Finance (USA) LLC f/k/a RZB Finance LLC, Natixis New York Branch, ABN AMRO Bank N.V., as successor by merger to Fortis Bank (Nederland) N.V., and Brown Brothers Harriman & Co., as Collateral Agent (as amended, modified, supplemented or replaced from time to time, the "Collateral Agency Agreement").

The Company may request a loan at or before 10:00 a.m., New York City time, on the date that is three (3) Business Days (as defined in the Note referred to below) prior to the date the Company wishes to borrow, in the case of a loan bearing interest based upon LIBOR (as defined in the Note) and on the date the Company wishes to borrow, in the case of other loans, by delivering to the Lender a borrowing request substantially in the form of Exhibit A hereto. The Company may request issuance of a letter of credit at or before 10:00 a.m., New York City time, on the proposed date of issuance by delivering to the Lender a request for issuance substantially in the form of Exhibit B hereto. If the Lender agrees to make the requested loan or issue or arrange for issuance of the letter of credit, the Lender will do so upon the terms and subject to the conditions contained herein and in the other Loan Documents (as. defined below). The loans will be evidenced by a promissory note in substantially the form annexed hereto as Exhibit C (as amended, modified, supplemented or replaced from time to time, the ''Note''). Each request for a loan or letter of credit shall be irrevocable.

In the event that at any time the outstanding principal amount of loans hereunder plus the maximum face amount of all outstanding letters of credit issued under any Loan Document plus reimbursement obligations with respect to drawings under such letters of credit shall exceed the maximum amount of the line of credit hereunder as set forth above, the Company shall immediately, first, pay outstanding loans and reimbursement obligations, and thereafter deposit cash collateral with the Lender in an amount sufficient to eliminate such excess.

In the event that at any time the Outstanding Credits (as defined in the Collateral Agency Agreement) shall exceed the Collateral Value of non CFC Collateral plus the Collateral Value of CFC Collateral (as defined in the Collateral Agency Agreement) shown on the most recently delivered Collateral Report (as defined in the Collateral Agency Agreement) (an "Excess"), the Company shall immediately, first, pay outstanding loans and reimbursement obligations to the Lender, and thereafter deposit cash collateral with the Lender in an amount sufficient to eliminate such Excess.

Documentation; No Commitment:

All promissory notes and other documents requested by the Lender in connection with this Agreement must be in form and substance satisfactory to the Lender. Also, the Lender asks the Company to note carefully that this is not a "committed" line of credit. No commitment fee will be charged, and the Lender may withdraw the line of credit at any time, with or without notice. Moreover, the Lender has no obligation to extend credit at any time, and the making of each loan or other extension of credit shall be in the Lender's sole discretion. NOTHING HEREIN CONTAINED, INCLUDING, WITHOUT LIMITATION, THE NEXT PARAGRAPH, THE EVENTS OF DEFAULT BELOW AND THE COVENANTS IN APPENDIX A, IS INTENDED TO OR SHALL MODIFY THE UNCOMMITTED NATURE OF THE CREDIT FACILITY OR SHALL IMPOSE ANY IMPLIED OBLIGATION ON THE LENDER TO EXTEND CREDIT AT ANY TIME.

Facility Maturity:

The Company shall not make any request for any loan, letter of credit or other credit extension after [January _ 2012] unless the Lender, in its sole discretion and without any obligation to do so, extends such date in writing.

Interest and Fees:

Without undertaking to make any loan or issue or arrange for issuance of any letter of credit, and without agreeing to any partiCUlar rate of interest or fees, the Lender notes for the Company's information that:

(a) Loans under the facility described herein shall bear interest at a rate equal to not less than *% per annum in excess of the Offered Rate, as defined in the Note.

(b) The fees for issuing a letter of credit under the facility described herein shall be not less than an issuance fee of *% flat per quarter or part thereof, with a minimum of $500, payable in advance.

(c) Each unreimbursed drawing in respect of a letter of credit issued hereunder, all letter of credit fees and other fees and expenses payable hereunder and all other amounts payable hereunder or under any Loan Document which are not paid when due shall, unless otherwise expressly provided in the Note, bear interest at a rate equal to not less than the Offered Rate as defined in the Note plus 2%. Such interest shall be payable by the Company on demand by the Lender.

|

| | |

| (d) | The fee for any amendment to a letter of credit is $200, payable in |

advance. | | |

| (e) | The Company shall also be obligated to pay to the Lender all other |

fees and charges customarily charged to customers in connection with letters of credit.

*Material omitted pursuant to a request for confidential treatment. An unredacted version of this exhibit has been filed separately with the Securities and Exchange Commission.

Unless otherwise agreed, interest and fees will be calculated on the basis of the actual number of days elapsed over a year of 360 days and shall be non-refundable. Representations and Warranties:

The Company hereby represents and warrants to the Lender that:

(a) Organization. The Company is a corporation, duly incorporated, validly existing and in good standing under the laws of the State of California; there are no other jurisdictions in which the nature of its business requires it to be qualified to do business as a foreign corporation, except those where it is duly qualified and in good standing; and the Company has the corporate power and authority, and the legal right, to own and operate its property, to lease the property it operates as lessee and to conduct the business in which it is currently engaged.

(b) Authorization. The execution, delivery and performance by the Company from time to time of each of this Agreement, the Note, the Continuing Agreement for Letters of Credit between the Company and the Lender dated as of the date hereof (as amended, modified, supplemented or replaced from time to time, the "LIe Agreement") and each security agreement, pledge agreement, guarantee, agreement, instrument and other document related hereto or to any of the foregoing including, without limitation, those executed in favor of the Collateral Agent from time to time (collectively, the "Loan Documents" and each a "Loan Document") in each case, to which it is a party, are within the corporate powers of the Company, have been duly authorized by all necessary corporate action, and do not and will not contravene (i) the certificate of incorporation or by-laws or other organizational documents (such as any shareholders agreement) of the Company or (ii) any law or regulation or any contractual restriction binding on or affecting it or any of its assets or property;

(c) Approvals. No authorization or approval, other action by or consent of, and no notice to or filing with, any governmental authority or regulatory body or any other person or entity is required for the due execution, delivery and performance by the Company of any of the Loan Documents;

(d) Enforceability. This Agreement is, and each of the other Loan Documents when delivered to the Lender will be, duly executed and delivered by the Company and constitutes or will constitute the legal, valid and binding obligations of the Company enforceable against the Company in accordance with their respective terms, subject to bankruptcy, insolvency, moratorium or other laws affecting the enforceability of rights of creditors generally;

(e) Financial Statements; No Material Adverse Change. The Company's most recent financial statements which the Company has previously furnished to the Lender, fairly present the Company's financial condition as of their date and the results of operations for the periods ended on such date, and are prepared in accordance with United States generally accepted accounting principles consistently applied; and since such date, there has been no event, circumstance or condition which has had a Material Adverse Effect; for purposes hereof, "Material Adverse Effect" shall mean a material adverse effect on (a) the business, assets, income, property, condition (financial or otherwise), performance, operations or prospects of the Company, or the Company and its subsidiaries taken as a whole, (b) the ability of the Company or any

subsidiary to perform any of its obligations under this Agreement or any of the other Loan Documents on a timely basis or (c) the validity or enforceability of this Agreement or any of the other Loan Documents or the rights or remedies of the Lender hereunder or thereunder;

(f) Litigation. There is no pending or (to the best of the Company's knowledge) threatened action or proceeding affecting the Company or any subsidiary of the Company before any court, governmental agency or arbitrator, and there is no governmental investigation or proceeding pending with respect to or affecting the Company or any such subsidiary in each case which (if adversely determined) could be expected to result in a Material Adverse Effect or result in loss, cost, liability or expense to the Company, or any such subsidiary in excess of [$100,000] (or the equivalent thereof in another currency) in the aggregate with respect to all such actions, proceedings or investigations;

(g) Compliance with Laws. The Company and its subsidiaries have complied and are in compliance with all applicable laws, regulations, ordinances, decrees and other similar documents and instruments of all governmental authorities, courts, bureaus and agencies, domestic and foreign;

(h) Subsidiaries and Affiliates. On the date hereof, the Company has no subsidiaries except as set forth in Exhibit D hereto, and said Exhibit D accurately lists all companies and individuals which directly or indirectly own or control the Company and all subsidiaries of such companies and individuals (such companies, individuals and subsidiaries of the Company and of such companies and individuals are referred to, collectively, as "Affiliates"); for purposes hereof, "control" means the power, directly or indirectly, either to (a) vote 10% or more of the securities or other equity interests having ordinary voting power for the election of directors or managers of a person or (b) direct or cause the direction of the management and policies of such person, whether by contract or otherwise;

(i) Investment Company Act; Other Legal Restrictions. None of the Company or any of its subsidiaries is an "investment company" or a company "controlled" by an "investment company" within the meaning of the Investment Company Act of 1940 (as amended from time to time) or is subject to any law or regulation limiting its ability to incur or pay the obligations under this Agreement and the other Loan Documents;

(j) Regulation U. The Company is not engaged in the business of extending credit for the purpose of purchasing or carrying margin stock (within the meaning of Regulation U issued by the Board of Governors of the Federal Reserve System), and no proceeds of any loan, letter of credit or other credit extension will be used to purchase or carry any margin stock or to so extend credit to others for the purpose of purchasing or carrying any margin stock; following application of the proceeds of each loan, letter of credit or other credit extension, not more than 25 percent of the value of the assets of the Company or the Company and its subsidiaries on a consolidated basis will be margin stock; and

(k) Disclosure. No representation, warranty or statement contained in this Agreement, the financial statements, the other Loan Documents, or any other document, certificate or written statement furnished to Lender by or on behalf of the Company for use in connection with the Loan Documents contains any untrue statement of a material fact or omitted, omits or will omit to state a material fact necessary in order to make the statements contained herein or therein not misleading in light of the circumstances in which the same were made. There is no material fact known to the Company that has had or will have a Material Adverse Effect and that has not been disclosed herein or in such other documents, certificates and statements furnished to Lender for use in connection with the transactions contemplated hereby.

Each of the making by the Company of any request for a loan, letter of credit or other credit extension and the receipt by the Company of the proceeds or the benefit of such loan, letter of credit or other credit extension requested in such request, shall constitute a representation and warranty by the Company that (x) the representations and warranties set forth herein and in each of the other Loan Documents are true and correct on and as of the date of such request and the date of such credit extension before and after giving effect thereto as if made on each such date; and (y) prior to and after the making or issuance, as the case may be, of such loan, letter of credit or other credit extension, no Event of Default (as defined in the Note or as set forth in Section I3 of the L/C Agreement or such event or condition, which, with the passage of time or the giving of notice or both, would become an Event of Default, has occurred and is continuing.

Covenants:

By using this facility, the Company agrees that it will comply with the provisions in Appendix A attached hereto and made a part hereof so long as this line of credit or any credit extended by the Lender to the Company remains outstanding. The Company's undertaking to comply with the terms of this Agreement does not in any way affect the uncommitted nature of the credit facility established by the Lender in the Company's favor or the demand nature of any credit extended to the Company.

Event of Default:

Without limiting the right of the Lender to demand payment of loans and cash collateral for letters of credit, or other extensions of credit or the right of the Lender to terminate this Agreement and/or decline to make any loan or issue or arrange for issuance of any letter of credit or other extensions of credit hereunder, if any Event of Default (as defined in the Note or as set forth in Section 13 of the L/C Agreement) (each an "Event of Default") shall occur and be continuing, the Lender may, by notice to the Company, declare all loans and reimbursement obligations and all accrued interest thereon to be forthwith due and payable and/or the Lender may require the Company to deposit immediately cash collateral with the Lender in an amount equal to the undisbursed maximum amount of each letter of credit issued for its account and of each other extension of credit, whereupon the loans and reimbursement obligations, all such interest and such amount of cash collateral shall become forthwith due and payable, without presentment, demand, protest or further notice of any kind, all of which are hereby expressly waived by the Company, provided that in the event of the occurrence of any Event of Default set forth in clause (i) of the definition of such term contained in the Note or as set forth in Section 13(i) of L/C Agreement, the loans, all such reimbursement obligations, such interest and such amount of cash collateral shall automatically become and be due and payable, without presentment, demand, protest or any notice of any kind, all of which are hereby expressly waived by the Company. The Company hereby expressly authorizes the Lender to setoff and apply such cash collateral to the payment of the Company's liabilities and obligations under this Agreement and the other Loan Documents.

Setoff:

The Company hereby further expressly authorizes the Lender, at any time and from time to time, without notice to the Company or to any other person or entity, any such notice being expressly waived by the Company, to setoff and apply any and all deposits (general or special) and other indebtedness or sums at any time held, credited or owing by ABN AMRO Capital USA LLC (including all of its branches and agencies) to or for the credit or account of the Company, in any currency and whether or not due, to the payment of the Company's liabilities and obligations, including, without limitation, any obligation to provide cash collateral, under this Agreement and the other Loan Documents, irrespective of whether or not the Lender shall have made any demand hereunder or thereunder and although said obligations or liabilities, or any of them, shall be contingent or unmatured.

Miscellaneous:

(a) This Agreement and the other Loan Documents shall be governed by and construed in accordance with the laws of the State of New York, without regard to principles of conflicts of laws. The Company hereby agrees that any legal action or proceeding against the Company with respect to this Agreement and the other Loan Documents may be brought in the courts of the State of New York in The City of New York or of the United States of America for the Southern District of New York as the Lender may elect, and, by execution and delivery hereof, the Company accepts and consents to, for itself and in respect of its property, generally and unconditionally, the jurisdiction of the aforesaid courts and agrees that such jurisdiction shall be exclusive, unless waived by the Lender in writing, with respect to any claim, action or proceeding brought by it against the Lender and any questions relating to usury. The Company agrees that Sections 5-1401 and 5-1402 of the General Obligations Law of the State of New York as in effect from time to time shall apply to this Agreement and, to the maximum extent permitted by law, waives any right to stay or to dismiss any action or proceeding brought before said courts on the basis of forum non conveniens. Nothing herein shall limit the right of the Lender to bring proceedings against the Company in any other jurisdiction. The Company irrevocably consents to the service of process in any such legal action or proceeding by personal delivery or by the mailing thereof by the Lender by registered or certified mail, return receipt requested, postage prepaid, to the address specified in the Lender's records, such service of process by mail to be deemed effective on the fifth day following such mailing. The Company agrees that a final judgment in any such legal action or proceeding shall be conclusive and may be enforced in any manner provided by law.

(b) AFTER REVIEWING THIS PROVISION SPECIFICALLY WITH ITS RESPECTIVE COUNSEL, EACH OF THE COMPANY AND THE LENDER HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVES ANY AND ALL RIGHTS THE COMPANY AND THE LENDER MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION BASED ON, OR ARISING OUT OF, UNDER, OR IN CONNECTION WITH, THIS AGREEMENT, THE OTHER LOAN DOCUMENTS OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER ORAL OR WRITTEN) OR ACTIONS OF THE COMPANY OR THE LENDER. THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE LENDER TO EXTEND CREDIT TO THE COMPANY. No claim may be made by the Company against the Lender or the affiliates, officers, directors, employees or agents of the Lender for any special, indirect, punitive or consequential damages in respect of any claim for breach of contract or any other theory of liability arising out of or related to any letter of credit requested by the Company or any draft or demand under any such letter of credit or any payment or nonpayment thereof, or any loan or other transaction contemplated by this Agreement or the other Loan Documents, or any act, omission or event occurring in connection with any of the foregoing, and the Company hereby waives, releases and agrees not to sue upon any claim for any such damages. Neither the Lender nor any other person or entity referred to in the preceding sentence shall be liable for any damages arising from the use by unintended recipients of any information or other materials distributed to such unintended recipients by the Lender or such other person or entity through telecommunications, electronic or other information transmission systems in connection with this Agreement or the other Loan Documents or the transactions contemplated hereby or thereby.

(c) The Company agrees to pay on demand all costs and expenses, including, without limitation, reasonable attorneys' fees and disbursements, of any nature incurred or paid by the Lender in connection with this Agreement or any other Loan Document, including, without limitation, such costs and expenses as may arise from the preparation, execution, delivery, administration, interpretation, protection, enforcement or collection of this Agreement, the Note, the L/C Agreement, the letters of credit and any applications or other agreements pertaining to the issuance thereof and all other Loan Documents and the costs and expenses of examination and audit of the Company's books

and records and of any collateral security for the loans and reimbursement obligations with respect to letters of credit or of defending any claim, action or proceeding asserted or commenced by the Company against the Lender. The provisions of this paragraph (c) shall survive the termination of the Loan Documents and the repayment of all liabilities to the Lender.

(d) The Company shall defend, indemnify and hold harmless the Lender, its affiliates, directors, officers, agents, employees, participants and assignees, from and against any and all claims, suits, actions, causes of action, debts, liabilities, damages, losses, obligations, charges, judgments, costs and expenses of any nature whatsoever, including, without limitation, attorneys fees and expenses, in any way relating to or arising from or in connection with (i) the execution or delivery of this Agreement or any other Loan Document or any other agreement or instrument contemplated hereby or thereby, the performance by the parties of their obligations under the Loan Documents or any such other agreement or instrument, or the consummation of the transactions contemplated by the Loan Documents, (ii) any loan, letter of credit or the use of proceeds thereof, (iii) any loss, damage or injury resulting from any hazardous material and/or (iv) any actual or prospective claim, litigation or proceeding relating to any of the foregoing, whether based on contract, tort or any other theory, whether brought by the Company or any other person or entity, and regardless of whether any of the foregoing indemnitees is a party thereto; provided that the foregoing indemnification shall not extend to claims, suits, actions, causes of action, debts, liabilities, damages, losses, obligations, judgments, costs and expenses to the extent caused by the gross negligence or willful misconduct of the Lender as determined by a final and nonappealable judgment of a court of competent jurisdiction. This indemnification provision shall survive the termination of the Loan Documents and the repayment of all liabilities to the Lender.

(e) All notices and other communications provided for hereunder and under the other Loan Documents shall be in writing and except as otherwise specified in any other Loan Document, mailed, telecopied or delivered, if to the Company, at its address at 429 Santa Monica Blvd., Suite 230, Santa Monica, CA 90401, Attention: Mr. Thor Gjerdrum (telecopier no. 310-260-0638) and if to the Lender, at its address at 100 Park Avenue, New York, New York 10017, Attention: Ms. Stacey Judd (telecopier no. 917-284-6683); or as to each party, at such other address 01' telecopy number as shall be designated by such party in a written notice to the other party. Except as otherwise specified in any Loan Document, all such notices and communications shall, when mailed (postage prepaid), telecopied with evidence of transmission, or sent by hand delivery or other courier or delivery service, be effective when telecopied or delivered to the recipient, or five days after being deposited in the mails. The Lender may act upon facsimile or other electronically transmitted instructions or requests which are received by the Lender from person(s) purporting to be, or which instructions or requests appear to be, authorized by the Company. The Company further agrees to indemnify and hold the Lender harmless from any claims by virtue of the Lender's acting upon such facsimile or

other electronically transmitted instructions or requests as such instructions or requests were understood by the Lender. In the event the Company sends the Lender a manually signed confirmation of the previously sent facsimile or other electronically transmitted instructions or requests, the Lender shall have no duty to compare it against the previous instructions or requests received by the Lender nor shall the Lender have any responsibility should the contents of the written confirmation differ from the facsimile or other electronically transmitted instructions or requests as acted upon by the Lender.

(I) All accounting terms not specifically defined herein shall be construed in accordance with United States generally accepted accounting principles consistently applied, except as otherwise stated herein.

(g) The powers, rights and remedies of the Lender specified in this Agreement and the other Loan Documents are cumulative and in addition to any other powers, rights and remedies that the Lender may otherwise have under any other agreement and under applicable law. No amendment, modification, termination, waiver or discharge, in whole or in part, of any provision of this Agreement or any other Loan Document to which the Company is a party, nor consent to any departure by the Company therefrom, shall be effective, unless the same shall be in writing and signed by the Company and the Lender. Any such amendment, modification, termination, waiver, discharge or consent shall be effective only in the specific instance and for the purpose for which given. No amendment, modification, termination, waiver, discharge or consent agreed to by the Lender shall, of itself, entitle the Company to any other or further amendment, modification, termination, waiver, discharge or consent in similar or other circumstances. No notice to or demand on the Company in any case shall, of itself, entitle it to any other or further notice or demand in similar or other circumstances.

(h) This Agreement and the other Loan Documents embody the entire agreement and understanding between the Lender and the Company and supersede all prior agreements and understandings relating to the subject matter hereof.

(i) This Agreement and the other Loan Documents shall be binding on the Company and its successors and assigns, and shall inure to the benefit of the Lender and its successors and assigns, provided that the Company shall not have the right to assign its rights or obligations hereunder or thereunder or any interest herein or therein without the Lender's prior written consent and any purported assignment by the Company without such consent shall be void and of no force or effect. In the event the Lender notifies the Company of any assignment by the Lender of its rights and obligations, if any, under this Agreement and the other Loan Documents (without any obligation of the Lender to do so), (a) such assignment shall be effective on the date set forth in such notice, (b) such assignee shall succeed to and assume all of the Lender's rights and obligations, if any, under this Agreement and, the other Loan Documents, and

(c) the Lender shall be released from all of such obligations.

0) No delay on the part of the Lender in exercising any powers, rights or remedies hereunder or under the other Loan Documents shall operate as a waiver thereof, nor shall any single or partial exercise of any such powers, rights or remedies preclude, limit or impair other, further or future exercise thereof, or the exercise of any other power, right or remedy.

(k) This Agreement may be executed in any number of counterparts and by each of the parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Signatures of the parties may appear on separate counterparts with the same effect as if on the same counterpart. Telecopied signatures on this Agreement, the other Loan Documents and any amendments thereto shall be binding on the Company to the same extent as originally signed signature pages.

(I) If any provision of this Agreement is invalid or unenforceable under the laws of any jurisdiction, then, to the fullest extent permitted by law, (i) such provision shall be ineffective to the extent of such invalidity or unenforceability, without invalidating or affecting the enforceability of the remainder of such provision or the remaining provisions of this Agreement; and (ii) such invalidity or unenforceability shall not affect the validity or enforceability of such provision in any other jurisdiction.

(m) The Company consents, without notice to or further assent by it, that the terms of this Agreement or any other Loan Document or any collateral for any of the obligations under this Agreement or any other Loan Document may from time to time, in whole or in part, be renewed, extended, modified, waived, compromised, or settled for cash, credit or otherwise upon any terms and conditions the Lender may deem advisable, and that the Lender may discharge or release any party from its obligations hereunder or any other Loan Document, and that any collateral may from time to time, in whole or in part, be exchanged, sold, released or surrendered by the Lender, all without in any way releasing the obligations of the Company hereunder or under any other Loan Document, and agrees that no such action or failure to act on the part of the Lender shall in any way affect or impair the obligations of the Company or be construed as a waiver by the Lender of, or otherwise affect, its right to avail itself of any remedy hereunder or under any other Loan Document.

(n) The Company agrees to pay all stamp, document, transfer, recording or filing taxes or fees and similar impositions now or hereafter determined by the Lender to be payable in connection with this Agreement or any other Loan Document or the transactions pursuant to or in connection herewith and therewith, and the Company agrees to save the Lender harmless from and against any and all present or future claims, liabilities or losses with respect to or resulting from any omission to payor delay in paying any such taxes, fees or impositions.

(0) The Company's obligations under this Agreement and the other Loan Documents shall be absolute, irrevocable and unconditional and shall be paid and

performed strictly in accordance with the terms of this Agreement or such other Loan Document under any and all circumstances.

(P) The Lender hereby notifies the Company that pursuant to the requirements of the Patriot Act, it is required to obtain, verify and record information that identifies the Company, which information includes the name and address of the Company and other information that will allow the Lender to identify the Company in accordance with the terms of the Patriot Act. As used herein, "Patriot Act" shall mean the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Public Law 107-56 (as amended). In addition, and without limiting the foregoing, the Company shall (a) ensure, and cause each of its subsidiaries to ensure, that neither the Company nor any person who owns a controlling interest in or otherwise controls the Company or any of its subsidiaries (directly or indirectly) is or shall be a person with whom the Lender is restricted from doing business under (i) regulations of the Office of Foreign Assets Control of the United States Department of the Treasury ("OFAC") including, without limitation, any person listed on the Specifically Designated Nationals and Blocked Person List maintained by OFAC (or any similar list maintained by OFAC, collectively, the "OFAC List"), or (ii) any similar regulations, statutes, laws, lists, or executive orders established or promulgated by the United States government or any agency thereof (the regulations, statutes, laws, lists and executive orders referred to in clauses (i) and (ii) above are collectively referred to as the "Regulations"); (b) not use or permit the issuance of letters of credit or use of the proceeds of any loans or other extensions of credit in a manner that would violate any Regulations; and (c) not, directly or indirectly, conduct any business with or engage in any transaction with any person named on the OFAC List, any person owned by, controlled by, acting for or on behalf of, providing assistance, support, sponsorship, or services of any kind to, or otherwise associated with, any person named on the OFAC List, or any other person with whom the Company is restricted from doing business under any Regulations. If the Company obtains any actual knowledge or receives any written notice that the Company, any of its Affiliates or any subsidiary is named on the OFAC List (an "OFAC Event"), the Company shall (i) promptly give written notice to the Lender of such OFAC Event and (ii) comply with all applicable laws with respect to such OFAC Event (regardless of whether the party included on the OFAC List is located within the jurisdiction of the United States of America), including the Regulations, and the Company hereby authorizes and consents to the Lender taking any and all steps the Lender deems necessary, in the Lender's sole discretion, to avoid violation of all applicable laws with respect to any such OFAC Event, including the requirements of the Regulations (including the freezing and/or blocking of assets and reporting such action to OFAC).

(q) Section headings in this Agreement are included for convenience of reference only and shall not constitute part of this Agreement for any other purpose or be given any substantive effect.

(r) Deposits and credit balances at the Lender are NOT insured by the Federal Deposit Insurance Corporation (the "FDIC") or by any other U.S. government agency. By executing this letter, the Company acknowledges its initial deposit or credit balance and all future deposits and credit balances will NOT be INSURED BY THE FDIC.

If the foregoing accurately reflects the understanding between us, kindly execute the enclosed copy ofthis letter in the space provided below and return it to us, whereupon this letter shall constitute a binding agreement between us.

Very truly yours,

ABN AMRO CAPITAL USA LLC

By:

Name:

Title: --------

By: Name: ___________ Title:

ACCEPTED AND AGREED TO:

A-MARK PRECIOUS METALS, INC.

By:

/s/ Thor Gjerdrum

Name: Thor Gjerdrum

Title: CFO

/s/ Rand Leshay

Name: Rand LeShay

Title: SVP Trading

Appendix A

The Company hereby covenants that while this Agreement remains in effect or any amount is outstanding in respect of any loan, letter of credit or other obligation to the Lender, the Company shall:

(a) Reporting Requirements. (i) Annual Financial Statements. Furnish the Lender, as soon as available and in any event within ISO days after the close of each of the Company's fiscal years, with the Company's consolidated and consolidating financial reports, certified in the case of the consolidated statements without qualification by independent certified public accountants, in form and substance satisfactory to the Lender, as of the end of and for such period including balance sheets and related profit and loss and surplus statements and statements of cash flows;

(ii) Monthly Financial Statements. Furnish the Lender, as soon as available and in any event within 60 days after the close of each month in each fiscal year, with unaudited consolidated and consolidating balance sheets and income statements and statements of cash flows of the Company, certified as accurate and complete by an authorized officer of the Company in form and substance satisfactory to the Lender, a management discussion of operating results and a compliance certificate, all in form and substance satisfactory to the Lender;

(iii) Collateral Reports. Furnish the Lender, prior to the close of business on the second Business Day of each week, with a Collateral Report and supporting schedules in the form required by the Collateral Agency Agreement, provided that if the Company shall request a loan or letter of credit when the most recently delivered Collateral Report did not reflect sufficient availability for such loan or letter of credit, the Company shall at the time of such request deliver a new Collateral Report reflecting that after giving effect to the requested loan or letter of credit, there would be no Excess (as defined in the seventh paragraph of this Agreement) as of such time; the Company acknowledges and agrees that each delivery of a Collateral Report to the Lender shall constitute a representation and warranty by the Company that the assets listed therein comply with all of the terms and provisions of the corresponding definition set forth in the Collateral Agency Agreement;

(iv) Evidence of Insurance. Furnish the Lender with evidence of renewal of each insurance policy of the Company (including, without limitation, marine insurance or other marine coverage) and copies of the renewed marine insurance policy (or other marine coverage) prior to the expiration thereof;

(v) Other Information. Furnish the Lender with such information respecting the condition and operations, financial or otherwise, of the Company, or any subsidiaries or Affiliates as the Lender may from time to time request;

(b) Audits by the Lender [and the Collateral AgentJ. Permit the [Collateral Agent] and the Lender and their respective representatives to conduct collateral audits at the Company's expense on such dates aud at such times as the Collateral Agent or the Lender, as applicable, shall determine in its sole discretion;

(c) Dispositions. Not, and not permit any of its subsidiaries to, sell, lease, transfer or otherwise dispose of any of its assets or any inventory, except (i) sales of inventory in the ordinary course of business and (ii) sales and dispositions of obsolete equipment no longer necessary or useful in the Company's or such subsidiary's business;

Cd) Merger and Consolidation. Not merge into or consolidate with or into any corporation or other entity, nor permit any of its subsidiaries to do so, without the prior written consent of the Lender;

(e) Restricted Payments. Not declare or make at any time any dividend payment or other distribution of assets, properties, cash, rights, obligations or securities on account of any capital stock, equity or membership interests of the Company or purchase, redeem or otherwise acquire for value any capital stock, equity or membership interests of the Company or any warrants, rights or options to acquire such capital stock, equity or membership interests, now or hereafter outstanding, without the prior written consent of the Lender, and not permit any of its subsidiaries to do any of the foregoing with respect to its own capital stock, equity or membership interests except for the payment of dividends and the making of distributions to the Company;

Cf) Financial Covenants. (i) Not permit at any time the Working Capital of the Company to be less than $25,000,000; as used herein, "Working Capital" shall mean at any time as to any person or entity as of the date of determination thereof, the excess of CA) current assets minus any current assets consisting of investments in and receivables and other obligations from subsidiaries and other Affiliates over (B) current liabilities, each determined in accordance with United States generally accepted accounting principles, consistently applied;

(ii) not permit at any time the sum of Tangible Net Worth plus Subordinated Debt of the Company to be less than $25,000,000. As used herein, "Tangible Net Worth" shall mean at any time as to any person or entity as of the date of determination thereof, the excess of total assets over total liabilities determined in accordance with United States generally accepted accounting principles, consistently applied, and less the sum of (without duplication):

(A) the total book value of all assets of such person or entity and its subsidiaries properly classified as intangible assets under United States generally accepted accounting principles, including such items as goodwill, the purchase price of acquired assets in excess of the fair market value thereof, trademarks, trade names, service marks, brand names, copyrights, patents and licenses, rights with respect

to the foregoing, organizational or developmental expenses, and all unamortized debt discount and expense; plus

(B) all amounts representing any write-up in the book value of any assets of such person or entity or its subsidiaries resulting from a revaluation thereof subsequent to December 31, [2010]; plus

(C) to the extent otherwise included in the computation of Tangible Net Worth, any SUbscriptions receivable; plus

(D) investments in and receivables and other obligations from subsidiaries and other Affiliates; plus

(E) any deferred charges, deferred taxes, prepaid expenses and treasury stock;

and "Subordinated Debt" shall mean all indebtedness of the Company which is subordinated on terms and conditions (including, without limitation, the identity of the creditor) satisfactory to the Lender to all of the Company's obligations and indebtedness to the Lender;

(iii) not permit at any time the ratio of (i) total obligations and liabilities of the Company to banks, financial institutions and affiliates thereof (including, without limitation, contingent obligations with respect to undrawn letters of credit), to (ii) Working Capital of the Company to exceed 5.0 to 1.0.

(g) Existence. Preserve its corporate existence and all licenses, registrations and permits necessary for the conduct of its business, maintain its properties in good repair, working order and condition, continue in the same lines of business and conduct its business substantially as it is being conducted now, and cause each of its subsidiaries to do all of the foregoing;

(h) Insurance. Maintain, and cause each of its subsidiaries to maintain, insurance with responsible and reputable insurance companies in such amounts and covering such risks as are usually carried by companies engaged in similar businesses and owning similar properties in the same general areas in which it conducts its business; take all steps necessary to assure that subject to deductibles and coinsurance, the full amount of any such insured account receivable will be paid under such policy; and cause all such insurance policies to contain loss payable endorsements and additional insured clauses satisfactory to the Lender in its sole discretion;

0) Compliance with Laws. Comply, and cause each of its subsidiaries to comply, in all material respects with applicable law and regulations;

G) Notice of Defaults. As soon as possible and in any event within five Business Days after the occurrence of each Event of Default and each event which, with the giving of notice or lapse of time, or both, would constitute an Event of Default, continuing on the date of such statement, deliver to the Lender a statement of the chief financial officer of the Company setting forth details of such Event of Default or event and the action which the Company has taken and proposes to take with respect thereto;

(k) Pari Passu Status. Take all action necessary to insure that the Company's obligations under the Loan Documents rank and will continue to rank at least pari passu in respect of priority of payment with its highest ranking indebtedness except as otherwise provided in the Intercreditor Agreement;

(I) Notice of Material Adverse Effect. Promptly notify the Lender of any event, circumstance or condition that had or could be expected to have a Material Adverse Effect;

(m) Location of Offices; Conduct of Business. Not move the Company's chief executive office or chief place of business, change its name, type or place of organization or organizational identification number, or conduct its business in any name other than as set forth on the signature page hereto, except with the prior written consent of the Lender;

(n) Organizational Documents. Not (and not permit any of its subsidiaries to) amend its certificate of incorporation or by-laws or other organizational documents without the prior written consent of the Lender;

(0) Affiliate Transactions. Not (and not permit any of its subsidiaries to) directly or indirectly: (a) make any investment in or loan or extension of credit to an Affiliate (as defined in paragraph (h) under the caption "Representations" in this Agreement); (b) transfer, sell, lease, assign or otherwise dispose of any assets to an Affiliate; (c) merge into or consolidate with or purchase or acquire assets from an Affiliate; or (d) enter into any other transaction directly or indirectly with or for the benefit of any Affiliate (including guarantees and assumptions of obligations of an Affiliate, management and consulting agreements and payment of management fees); provided, however, that: (i) any Affiliate who is a natural person may serve as an employee, officer or director of the Company or a subsidiary and receive reasonable compensation for his services in such capacity and (ii) the Company or a subsidiary may enter into any transaction with an Affiliate providing for the purchase of inventory in the ordinary course of business if (x) the monetary or business consideration arising therefrom would be substantially as advantageous to the Company or such subsidiary as the monetary or business consideration that would be obtained in a comparable arm's length transaction with a person that is not an Affiliate; and (y) the Company shall have given the Lender prior notice of the terms of such transaction and copies of all documents relating thereto as the Lender shall request;

(P) Indebtedness. Not (and not permit any subsidiary to) incur or permit to exist any liabilities or indebtedness for borrowed money or in respect of letters of credit or bankers acceptances, except to the Lender and to banks and financial institutions party to the Intercreditor Agreement;

(q) Loans and Other Investments. Not (and not permit any subsidiary to) make or permit to exist any loan, extension of credit, advance or investment to or in any person or entity, or any guarantee thereof, other than accounts receivable arising in the ordinary course of business and investments in cash and cash equivalents;

(r) Liens. Not, and not to permit any of its subsidiaries to, create or permit to exist any mortgage, charge, lien or other encumbrance with respect to any of its assets, other than liens consented to by the Lender in writing and liens in favor of the Collateral Agent on behalf of the banks and financial institutions party to the Intercreditor Agreement;

(s) Guaranties. Not and not permit any of its subsidiaries to assume, endorse, be or become liable for, or guarantee, the obligations of any person or entity, except by the endorsement of negotiable instruments for deposit or collection in the ordinary course of business. For the purposes hereof, the term "guarantee" shall include any agreement, whether such agreement is on a contingency basis or otherwise, to purchase, repurchase or otherwise acquire indebtedness or obligations of any other person or entity, or to purchase, sell or lease, as lessee or lessor, property or services, in any such case primarily

for the purpose of enabling another person or entity to make payment of indebtedness or obligations, or to make any payment (whether as an advance, capital contribution, purchase of an equity interest or otherwise) to assure a minimum equity, asset base, working capital or other balance sheet or financial condition, in connection with the indebtedness or obligations of another person or entity, or to supply funds to or in any manner invest in another person or entity in connection with its indebtedness or obligations;

EXHIBIT A

FORM OF BORROWING REQUEST! [Date]

ABN AMRO Capital USA LLC

100 Park Avenue NewYork,NewYork 10017 Attention: ______

Re: A-Mark Precious Metals, Inc.

Ladies and Gentlemen:

This Borrowing Request is delivered to you pursuant to the line letter agreement dated as of January _, 2011 (as amended, supplemented or otherwise modified from time to time, the "Line Letter"), between A-Mark Precious Metals, Inc. (the "Borrower") and ABN AMRO Capital USA LLC (the "Lender"). Capitalized terms used herein and not otherwise defined herein shall have the meanings given to them in the Promissory Note dated January _, 2011 (as amended, supplemented or otherwise modified from time to time) made by the Borrower.

The Borrower hereby irrevocably requests a loan in the amount of $_--

The requested borrowing date is ____

The maturity date of the loan will be ____ , .

The loan will bear interest at the rate specified below plus the margin set forth in the Line Letter:

o the Offered Rate

o LIBOR

o the Base Rate

The Borrowing Request must be received by the Lender prior to 10:00 am (New York City time), (a) three (3) Business Days prior to the requested borrowing date, if all or any part of the requested loans are initially to bear interest based upon LIBOR, or (b) otherwise, on the same Business Day as the requested borrowing date.

The Interest Period2 requested by the Borrower for the loan will be:

o one month.

o three months.

o six months.

o [specify]

The Borrower hereby represents and warrants as of the date that the loan being requested hereby is made that (i) each of the representations and warranties made by the Borrower in the Line Letter are true and correct in all material respects on and as of such date as if made on such date, except for those representations and warranties that by their terms were made as of a specified date, which shall be true and correct in all material respects on and as of such specified date, (ii) no Event of Default (as defined in the Line Letter) or event that with the lapse of time or giving of notice or both would constitute an Event of Default has occurred and is continuing as of such date or after giving effect to the loan being requested hereby, and (iii) after giving effect to the loan requested hereunder, no Excess (as defined in the Line Letter) will exist. Without limiting the foregoing, the Borrower hereby certifies that after giving effect to the loan requested hereby, the principal and face amount of all Obligations to all Lenders are less than the Collateral Value after giving effect to any changes in the Collateral Value and Obligations subsequent to the date of the most recent Collateral Report delivered to such Lender (all capitalized terms used in this sentence shall have the meanings ascribed thereto in the Intercreditor Agreement).

[Signature page follows]

2 Applies only if loan will bear interest based upon L1BOR or the Offered Rate.

The Borrower has caused this Borrowing Request to be executed and delivered, and the representations and warranties contained herein to be made, by a duly authorized representative as of the date ftrst mentioned above.

A-MARK PRECIOUS METALS, INC.

By: _______________________

Name: Title:

EXHIBITB

FORM OF LETTER OF CREDIT REQUEST FOR ISSUANCE OF LETTER OF CREDIT

[Date]

ABN AMRO Capital USA LLC

100 Park Avenue New York, New York 10017 Attention: -----

Re: A-Mark Precious Metals, Inc,

Ladies and Gentlemen:

This Letter of Credit Request is delivered to you pursuant to the line letter agreement dated as of January _, 2011 (as amended, supplemented or otherwise modified from time to time. the "Line Letter"), between A-Mark Precious Metals. Inc. (the "Borrower") and ABN AMRO Capital USA LLC (the "Lender"). Capitalized terms used herein and not otherwise defined herein shall have the meanings given to them in the Line Letter.

The Borrower hereby irrevocably requests that a letter of credit be issued or provided on its behalf.

The maximum liability under such letter of credit is $__.

The requested date on which the letter of credit is to be issued is __--'

The beneficiary of the letter of credit, [INSERT NAME) (the "Beneficiary"), is located at [ADDRESS).

The letter of credit will expire or terminate on • 20 . In the case of a drawing or a demand for payment, the Beneficiary shall present [SPECIFY DOCUMENTS NECESSARY TO BE DELIVERED FOR SUCH ACTIONS).

The delivery instructions for the letter of credit are as follows:

The form of the proposed letter of credit is attached hereto as Exhibit A.

The Borrower hereby represents and warrants as of the date that the letter of credit being requested hereby is issued that (i) each of the representations and warranties made by the Borrower in the Line Letter are true and correct in all material respects on and as of such date as if made on such date, except for those representations and warranties that by their terms were made as of a specified date, which shall be true

and correct in all material respects on and as of such specified date, (ii) no Event of Default or event that with the lapse of time or giving of notice or both would constitute an Event of Default has occurred and is continuing as of such date or after giving effect to the letter of credit being requested hereby, and (iii) after giving effect to the letter of credit requested hereby, no Excess will exist. Without limiting the foregoing, the Borrower hereby certifies that after giving effect to the letter of credit requested hereby, the principal and face amount of all Obligations to all Lenders are less than the Collateral Value after giving effect to any changes in the Collateral Value and Obligations subsequent to the date of the most recent Collateral Report delivered to such Lender (all capitalized terms used in this sentence shall have the meanings ascribed thereto in the Intercreditor Agreement).

[Signature page follows 1

The Borrower has caused this Letter of Credit Request to be executed and delivered, and the representations and warranties contained herein to be made, by a duly authorized representative as of the date first mentioned above.

A-MARK PRECIOUS METALS, INC.

By:~____________________ Name: _____________________ Title:

Exhibit A to Letter of Credit Request [Form of Letter of Credit]

EXHIBITC [Form of Note]

EXHIBITD

List of Subsidiaries and Affiliates REOUEST TO HONOR ORAL AND ELECTRONIC INSTRUCTIONS

Date: March 18,2011

ABN AMRO Capital USA LLC

100 Park Avenue New York, New York 10017

Re: Credit and Lending Relationship In the Name of A-Mark Precious Metals, Inc.

Ladies and Gentlemen:

The undersigned is duly organized and existing under the laws of its state of incorporation or organization.

The undersigned is the holder of an account on your books or has some other credit or financing relationship with you.

From time to time, the undersigned or one or more officers, agents, attorneys-infact or employees of the undersigned may transmit to you instructions concerning its credit or financing relationship with you orally, whether in person or by telephone, or by telefax, teiecopier, e-mail or similar means of electronic transmission of documents. The undersigned hereby requests that you comply with and honor each and every such instruction (hereinafter referred to as "instructions") as if duly made in writing by or on behalf of the undersigned. The undersigned acknowledges that you will process instructions or any instruction seeking to cancel or amend any prior instruction only on days on which you are open for business at your principal office and within your established cutoff hours as from time to time in effect. In the event any instruction is given, you are authorized to seek confirmation of such instruction by (a) telephone call back to anyone designated on the Schedule attached hereto, which Schedule may be amended from time to time but only in a writing actually received and acknowledged by you, (b) confirming a personal identification number appearing on or mentioned in any such instruction, or (c) any other security procedure agreed in writing between you and us. We hereby acknowledge that (x) each security procedure referred to in (a), (b) or (c) of the preceding sentence is commercially reasonable, and (y) you shall not be obligated to verify any instructions pursuant to any of the above security procedures from time to time in effect.

In consideration of your honoring or complying with such instructions and of your continuing to maintain the relationship with the undersigned, the undersigned hereby agrees to indemnify you and your directors, officers, agents and employees and hold you

A·Mnrk OrlllFlIx.doc

and them harmless from any liability, expense, cost or loss which you or they may incur or suffer by reason of honoring or complying with any and all such instructions. The undersigned specifically authorizes you to honor or comply with each and every such instruction believed by you to be genuine. Under no circumstances shall the undersigned seek to hold you or any of your directors, agents, officers or employees liable for any losses suffered by reason of you or any of them honoring or complying with any such instructions believed by you or them to be genuine. In receiving and processing our instructions and in issuing payment orders in furtherance thereof, you, to the maximum extent permitted by law, shall not be liable for: (i) events or circumstances beyond your reasonable control, (ii) indirect, punitive, special or consequential damages, even if you are advised as to the possibility thereof or (iii) non-compliance with instructions that are not sent by us in accordance with requirements set forth in other agreements between you and us.

It is understood and agreed that you and the beneficiary's bank in any funds transfer may solely rely upon any account number or similar identifYing number provided by us to identifY (i) the beneficiary, (ii) the beneficiary's bank, or (iii) an intermediary bank. You may debit our account in connection with any payment orders issued by you using any such identifYing numbers, even where their use may result in a person other than the beneficiary being paid, or in the transfer of funds to a bank other than the beneficiary's bank or an intermediary bank designated by us.

The undersigned may at any time terminate this request and the agreements contained herein by delivering to you written notice of termination receipted for by you in writing. Such termination shall be effective five business days after its receipt by you (or on such later date as may be specified in the notice) but shall not have any effect on the obligations of the undersigned which arose hereunder or on any action taken by you hereunder prior to the effective date of such termination. The undersigned acknowledges that you may terminate the service requested hereby or decline to honor any instruction at any time provided that you shall give subsequent notice to the undersigned as soon as practicable after such termination or your refusal to honor any instruction, and such termination shall not have any effect on the obligations of the undersigned which arose hereunder or on any action taken by you hereunder prior to the effective date of such termination. The undersigned also agrees that you may, in your discretion, refuse to honor or comply with any instruction received by you and may insist such instruction be made in writing, duly executed by or on behalf of the undersigned.

This agreement shall be governed by and construed in accordance with the laws of the State of New York, without regard to its conflicts of laws principles, and the undersigned hereby consents to the personal jurisdiction of the courts of the State of New York located in the City of New York and of the United States District Court for the Southern District of New York, as you may elect, in any action or proceeding arising under or relating to this agreement. THE UNDERSIGNED WAIVES TRlAL BY JURY IN ANY SUCH ACTION OR PROCEEDING.

-2

Very truly yours,

A-MARK PRECIOUS METALS, INC.

Schedule Dated As of March 18, 2011 Telephone Numbers and Names ofPersons Authorized to Confirm Instructions

Phone Numbers

310587-1485 Rand LeShay 310587-1414 Thor Gjerdrurn 310587-1485 Nick Sarantes 310587-1485 Roy Friedman

PROMISSORY NOTE

U.S.$25,OOO,OOO March 18, 2011

The undersigned, for value received, jointly and severally, promises to pay to the order of ABN AMRO Capital USA LLC (hereinafter called the "Lender ") the principal sum of TWENTY FIVE MILLION UNITED STATES DOLLARS (U.S.$25,OOO,OOO), or such lesser amount as shall equal the outstanding principal amount of all loans made by the Lender (the "Loans ") to the undersigned, payable on demand by Lender, but in any event not later than the maturity date for each such Loan agreed to by the Lender and the undersigned at or prior to the time such Loan is made. In no event shall the maturity date for any Loan be more than 90 days after such Loan is made. The Lender shall have no obligation to make any Loan to the undersigned.

The undersigned also promises to pay to the order of the Lender interest on the unpaid principal amount of each Loan evidenced hereby, from the date when made until the principal amount thereof is repaid in full, at such rates of interest as shall be agreed upon from time to time between the undersigned and the Lender at or prior to the time each Loan is made or, if not so agreed, at a rate per annum equal to the Base Rate (as hereinafter defined) plus .* Interest shall be paid at such monthly, quarterly or semiannual intervals as shall be agreed from time to time between the undersigned and the Lender or, if not so agreed, monthly on the last Business Day (as hereinafter defined) of each month, at maturity of each Loan (whether at stated maturity, on demand, by acceleration or otherwise) and on each date of any payment of principal of any Loan, on the amount paid. All interest payable hereunder shall be calculated on the basis of a 360 day year and actual days elapsed.

Any amount of principal of any Loan and, to the extent permitted by applicable law, any interest payable thereon which is not paid when due, whether at stated maturity, on demand, by acceleration or otherwise, shall bear interest for each day from the day when due until paid in full, payable on demand, at a rate per annum equal to the higher of: (a) ______* per annum in excess of the interest rate in effect with respect to such Loan prior to the date when due, and (b) _____* per annum in excess of the Base Rate.

*Material omitted pursuant to a request for confidential treatment. An unredacted version of this exhibit has been filed separately with the Securities and Exchange Commission.

The rate of interest agreed to with respect to any Loan shall be a fixed rate expressed as a percentage per annum or a margin (expressed as a percentage per annum) in excess of one of the following: (i) the "Base Rate"; or (ii) "LIBOR"; or (iii) the "Offered Rate". "Base Rate" shall mean the rate of interest equal to the higher (redetermined daily) of (i) the per annum rate of interest established by JPMorgan Chase Bank, N.A. (or any successor, "JPM") from time to time at its principal office in New York City as its prime rate or base rate for U.S. dollar loans (such rate is a reference rate established by JPM from time to time and does not necessarily represent the lowest or best rate actually charged by JPM or the Lender to any customer), (ii) LIBOR for an Interest Period of one month ("One Month LIBOR") plus 1.00% (for the avoidance of doubt, One Month LIBOR for any day shall be based on the rate appearing on Reuters Screen LIBOROI Page (or such other page as may replace Reuters Screen LIBOROI Page on the Reuters service) or other publicly available source providing such quotations as designated by the Lender from time to time, at approximately II :00 a.m. London time on such day), or (iii) the Federal Funds Rate, plus one half of one per cent (0.5%) per annum. Any change in the Base Rate due to a change in any of such rates referred to above shall be effective as of 12:01 a.m. (New York City time) on the day such change becomes effective. "Federal Funds Rate" shall mean for any day, the weighted average of the rates on overnight Federal Funds transactions with members of the Federal Reserve System arranged by Federal Funds brokers, as published on the next succeeding Business Day by the Federal Reserve Bank of New York, or, if such rate is not so published for any day that is a Business Day, the average of the quotations for such day for such transactions received by the Lender from three Federal Funds brokers of recognized standing selected by it. "LIBOR" shall mean for any Interest Period for any Loan, the interest rate reported on Reuters Screen LIBOROI Page (or such other page as may replace Reuters Screen LIBOROI Page on the Reuters service) or other publicly available source providing such quotations as designated by the Lender from time to time, at or about 11:00 a.m., London time, two (2) Business Days prior to the first day of such Interest Period (rounded upward, if necessary, to the nearest 1I16th of 1%), as the representative rate at which banks are offering United States Dollar deposits in the London interbank market, for delivery on the first day of such Interest Period, for a term comparable to such Interest Period. "Offered Rate" shall mean the rate per annum determined by the Lender at which U.S. dollar deposits, loans or advances of an amount comparable to the amount of the respective Loan and for a period comparable to the relevant Interest Period are offered to the Lender in such market or from such other funding source (including, without limitation, the Lender's affiliated banks and companies) as the Lender shall select from time to time in its sole discretion (rounded upward, if necessary, to the nearest 1116 of 1%) at or about 11:00 a.m. (New York City time) on the date of the commencement of each Interest Period or, if so selected by the Lender, on the first or second Business Day prior to such commencement, such rate to be increased to reflect all market, liquidity and regulatory conditions which the Lender deems applicable from time to time and to remain in effect for the entire Interest Period. "Interest Period" shall mean, with respect to each Loan evidenced hereby, (i) initially, the period commencing on the date of such Loan and ending one Business Day, or one, three or six months thereafter (or such other period as shall be acceptable to the Lender), in each case selected by the undersigned not less than three Business Days prior to the date on which such Loan is made or, in the case of the Offered Rate, selected by the undersigned on the date of the Lender's determination of the Offered Rate for such Interest Period, and (ii) thereafter each period commencing on the last day of the immediately preceding Interest Period for such Loan and ending one Business Day, or one, three or six months thereafter (or such other period as shall be acceptable to the Lender), in each case selected by the undersigned not less than three Business Days prior to the first day of such period or, in the case of the Offered Rate, selected by the

-2

undersigned on the date of the Lender's determination of the Offered Rate for such Interest Period; provided that: (a) any Interest Period which would otherwise end on a day which is not a Business Day shall be (i) extended to the next succeeding Business Day or (ii) if such next succeeding Business Day falls in another calendar month, shortened to the next preceding Business Day, except in respect of an Interest Period which ends the next Business Day; (b) any Interest Period of one month or longer which begins on a day for which there is no numerically corresponding day in the calendar month during which such Interest Period is to end shall, subject to the provisions of clause (a) above, end on the last day of such calendar month; (c) if the undersigned shall fail to select an Interest Period for any reason, it shall be deemed to have elected that the applicable Loan shall bear interest at the Offered Rate for an Interest Period commencing on the date such Loan is made or the last day of the preceding Interest Period for such Loan, as applicable, and ending on the next Business Day plus the applicable margin for such Offered Rate Loans or, if there is no applicable margin for such Offered Rate Loans, the applicable margin for Loans bearing interest at a rate based on LIBOR; and (d) no such Interest Period shall expire after the maturity date of the applicable Loan. "Business Day" shall mean any day that is not a Saturday, a Sunday or any other day on which commercial banks in New York are authorized or required by law to remain closed and, with respect to any Loan bearing interest at a rate based on LIBOR, the term "Business Day" shall also exclude any day on which banks are not open for dealings in dollar deposits in the London interbank market, and, with respect to any Loan bearing interest at a rate based on the Offered Rate, in the city where the applicable interbank market is located.

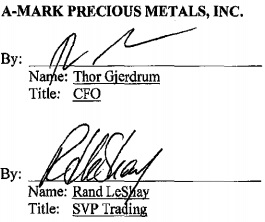

The Lender may record on its books and records or on the schedule to this Note which is a part hereof, the principal amount and date of each Loan made hereunder, the interest rate applicable thereto, the maturity date thereof and all payments of principal made thereon; provided, however, that prior to the transfer of this Note all such information with respect to all outstanding Loans shall be recorded on the schedule attached to this Note. The Lender's record, whether shown on its books and records or on the schedule to this Note, shall be conclusive and binding upon the undersigned, absent manifest error, provided, however, that the failure of the Lender to record any of the foregoing shall not limit or otherwise affect the obligation of the undersigned to repay all Loans made hereunder, together with all interest thereon and all other amounts payable hereunder. Without limiting the foregoing, the undersigned acknowledges that interest rates and maturity dates are ordinarily negotiated between the undersigned and the Lender by telephone and the undersigned agrees that in the event of any dispute as to any applicable interest rate and/or maturity date, the determination of the Lender and its respective entry on the schedule herein referred to shall be conclusive and binding upon the undersigned.

All payments hereunder shall be made at the office of the Lender at 100 Park Avenue, New York, New York 10017 or at such other place as the Lender may designate, in lawful money of the United States of America and in immediately available funds,

without setoff, recoupment, deduction, defense or counterclaim and free and clear of, and, except as required by applicable law, without deduction or withholding for or onaccount of, any present or future income, franchise, excise, stamp or other taxes, levies, imposts, duties or other charges of any kind now or hereafter imposed by any governmental or taxing authority, but excluding taxes imposed on or measured by the net income of the Lender by the jurisdiction of its organization, the United States of America or the State or City of New York or any taxing authority thereof (such non-excluded items, "Taxes"). If, under applicable law, any such Taxes are required to be deducted or withheld from any such payment, the undersigned will pay additional interest or will make additional payments in such amounts as may be necessary so that the net amount received by the Lender, after withholding or deduction therefor and for any Taxes and other taxes on such additional interest or amounts, will be equal to the amount provided for herein. The undersigned hereby agrees to indemnifY and to hold the Lender harmless against, the full amount of Taxes, imposed on or paid by the Lender, and any liability (including penalties, additions to tax, interest and expenses) arising therefrom or with respect thereto. The indemnity by the undersigned provided for in this paragraph shall apply and be made whether or not the Taxes for which indemnification hereunder is sought have been correctly or legally asserted. Amounts payable by the undersigned under the indemnity set forth in this paragraph shall be paid within ten (!0) days from the date on which the Lender makes written demand therefor. Determinations by the Lender pursuant to this paragraph shall be conclusive absent manifest error. The agreements of the undersigned in this paragraph shall survive the termination of the Loan Documents (as defined below) and the repayment of all Liabilities to the Lender. The undersigned agrees to furnish promptly to the Lender official receipts evidencing payment of any Taxes so withheld or deducted.

If any payment due hereunder shall be due on a day that is not a Business Day, payment shall be made on the next succeeding Business Day at such place of payment and interest thereon shall be payable for such extended time.

This Note may be prepaid at any time without premium or penalty except payment of the amounts provided for in the next paragraph. Each prepayment shall be accompanied by all accrued interest on the amount prepaid.

If any payment of the principal of a Loan evidenced hereby (other than Loans bearing interest based on the Base Rate) is made on a day other than the last day of an Interest Period applicable thereto for any reason, including, without limitation, voluntary pre-payment or acceleration, or if the undersigned fails to borrow any proposed Loan (other than Loans bearing interest based on the Base Rate) after the Lender has arranged funding thereof, or if the interest rate on any Loan is converted as provided in the second succeeding paragraph, the undersigned shall pay to the Lender, on demand, the amount of any loss, cost or expense ("Funding Loss") incurred by the Lender as a result of the timing of such payment, such failure to borrow or such conversion, including, without limitation, any loss incurred in liquidating or redeploying funds received or borrowed

-4

from third parties. The agreements of the undersigned in this paragraph shall survive the termination of the Loan Documents and the repayment of all Liabilities to the Lender.

In the event that on any date on which UBOR or the Offered Rate is to be determined with respect to an Interest Period: (i) the Lender determines that advances or other funding in dollars in the principal amount of the Loan to which such Interest Period applies are not being offered to the Lender in the London interbank market or such other applicable market or from such other funding source, as the case may be, for the applicable Interest Period or (ii) LIBOR does not accurately reflect the cost of the Lender of maintaining or funding the principal amount thereof, then the affected Loan shall, on receipt of notice from the Lender of such circumstances, bear interest at a rate per annum equal to the rate of interest determined by the Lender, such determination to be conclusive absent manifest error, to be ___% over its cost of funding the Loan using sources selected by it other than the London interbank market or such other applicable market or funding source, as the case may be, for dollars or, if the Lender so elects in its sole discretion, at the Base Rate.