EXECUTION COPY

A-MARK PRECIOUS METALS, INC.

SIXTH AMENDMENT DATED AS OF OCTOBER 29, 2010 TO

AMENDED AND RESTATED COLLATERAL AGENCY AGREEMENT (1999),

AMENDED AND RESTATED INTERCREDITOR AGREEMENT (1999), AND

AMENDED AND RESTATED GENERAL SECURITY AGREEMENT (1999)

EACH DATED AS OF NOVEMBER 30,1999,

AND EACH AS AMENDED

THIS SIXTH AMENDMENT is dated as of October 29, 2010 by and among BNP PARIBAS ("BNP") as successor to FORTIS CAPITAL CORP., ("FCC"), RB INTERNATIONAL (USA) LLC, f/k/a RZB FINANCE LLC ("RZB"), NATIXIS, NEW YORK BRANCH ("NATIXIS"), ABN AMRO Bank N.V. ("ABN") as successor to FORTIS BANK (NEDERLAND) N.V. ("FORTIS BANK NEDERLAND") and BROWN BROTHERS HARRIMAN & CO. ("BBH" in its capacity as agent for itself as a Lender (as defined below) and all other Lenders the "Agent") and A-MARK PRECIOUS METALS, INC., a New York corporation (the "Company"). BNP, RZB, NATIXIS, ABN and BBH are hereinafter sometimes referred to collectively as the "Lenders".

RECITALS

A. The Company, the Lenders and the Agent are parties to one or more of the: (i) Amended and Restated Collateral Agency Agreement (1999) dated as of November 30, 1999 (the "Agreement"); (ii) Amended and Restated Intercreditor Agreement (1999) dated as of November 30, 1999 (the "Intercreditor Agreement"); and (iii) Amended and Restated General Security Agreement (1999) dated as of November 30, 1999 (the "Security Agreement"), as each has been amended by amendments dated as of August 21, 2002, November 30, 2003, November 30, 2004, March 29, 2006 and March 31, 2010. The capitalized terms used in this Sixth Amendment shall have the meaning given each such term in the Agreement, as amended unless

otherwise defined herein.

B. By virtue of a statutory merger under Dutch law, ABN is the successor in interest to all of the rights and obligations of Fortis Bank Nederland, including, without limitation, all of its rights and obligations under the Facility Documents. Accordingly, since July 1,2010, the date of the merger of Fortis Bank Nederland into ABN, ABN became a Lender, and a party to the Agreement and the other Facility Documents, as amended.

C. FCC has transferred to BNP all of its rights and obligations under the Facility Documents and BNP has become a Lender and a party to the Agreement and the other Facility Documents as amended.

D. Pursuant to the provisions of the Fourth Amendment dated as of March 29, 2006, each of the Existing Lenders agreed to consider in its sole discretion to make advances to the Company, which were to be readvanced to Collateral Finance Corporation ("CFC"), a wholly owned subsidiary of the Company, for the purpose of enabling CFC to engage in the business of making loans to its borrowers secured by bullion and/or numismatically valuable or rare coins, which loans and collateral are to be assigned by CFC to the Company and by the Company to the Agent for the benefit of the Lenders,

E. The Company has requested that the Lenders consider in their respective sole discretion to continue to make advances to the Company which are to be readvanced to CFC, for the purpose described in Recital D above. The

Lenders have agreed to consider in their respective sole discretion to do so, on the terms and conditions set forth in the Facility Documents as amended by this Sixth Amendment and their respective loan documents.

F. The Company, the Lenders and the Agent, desire to amend the Agreement, the Facility Documents and the Exhibits and the Schedules annexed to the Agreement to: (i) revise the method of calculating: Collateral Value, (ii) confirm each of ABN and BNP as a Lender, and (iii) provide for changes in the CFC Loan Documents and for other additional changes, all on the terms and conditions provided for herein.

G. The foregoing Recitals are incorporated and made a part of this Sixth Amendment and the Agreement.

NOW, THEREFORE, the parties hereby agree as follows:

SECTION 1. AMENDMENTS TO THE AGREEMENT.

The Agreement is hereby amended as follows:

(a) Section I "Definitions" is hereby amended to add in alphabetical order or modify the following terms:

"Eligible CFC Loan" shall mean each CFC Loan as to which the Agent has received a duly executed CFC Loan Assignment and Company Assignment and the related CFC Loan Documents, in form, scope and substance, from time to time, acceptable to the Agent and the Lenders, which shall have been certified by an officer of CFC and the Company as being true and complete copies and is otherwise acceptable to the Agent, provided, in no event shall a CFC

Loan be deemed eligible, if (a) it together with all other outstanding CFC Loans to the same CFC Borrower are in excess of $5,000,000, or (b) the aggregate amount outstanding under all CFC Loans as at the date of computation shall be in excess of $25,000,000 unless the Agent, on behalf of and with the consent of all the Lenders, shall in writing approve an amount in excess of $25,000,000, or (c) the CFC Loan is secured by non-Bullion Collateral and the aggregate amount of all CFC Loans secured by non-Bullion Collateral (after giving effect to such proposed loan) is more than $18,750,000, or (d) a CFC Loan secured by Bullion Collateral is more than 95% of the Appraisal Value of such Bullion Collateral, or (e) a CFC Loan secured by Numismatic Collateral is more than 75% of the Appraisal Value of such Numismatic Collateral, or (f) a CFC Loan secured by Semi-Numismatic Collateral is more than 85% of the Appraisal Value of such Semi-Numismatic Collateral, or (g) the CFC Loan is not in compliance with any of the laws and regulations of the State of California, including, but not limited to those pertaining to usury and the licensing of CFC as a licensed lender, or (h) the term of the CFC Loan is more than six (6) months, or (i) CFC has granted a lien on any of its rights under such CFC Loan or the CFC Loan Documents to any person other than the Company or the Agent, or (j) any material provision of any CFC Loan Document is not valid, binding and enforceable, on and against the CFC Borrower; or the Agent's security interest in the CFC Collateral or the CFC Loan Documents is not a valid and perfected first priority security interest in favor of the Agent; or the CFC Borrower or CFC shall have any defense, setoff or other claim or right to reduce the amount payable under the CFC Loan Documents or CFC's obligations to the Company or any payment default or bankruptcy default shall have occurred with respect to the CFC Borrower or CFC, or (k) the CFC Collateral for such CFC Loan is not held at a CFC Approved Depository, or any other Approved Depository as shall be applicable, which has executed a Depository Agreement under which the Agent shall have the right to take exclusive control over such CFC Collateral, or (1) the Company and CFC have failed to comply with all of the terms and conditions contained in Section IV (J) hereof."

(b) Section II(C)(2) (Other Components of Collateral Value) is hereby amended by restating paragraph (k) in its entirety, to read as follows:

"(k) an amount equal to (i) 70% of the aggregate principal amount of the then outstanding Eligible CFC Loans secured by CFC Collateral (other than Bullion Collateral), plus (ii) 80% of the aggregate principal amount of the then outstanding Eligible CFC Loans secured by Bullion Collateral;"

(c) The terms "this Agreement", "Intercreditor Agreement" and "Security Agreement", and terms of similar import, as each is used in the Agreement, the Intercreditor Agreement, the Security Agreement and the other Facility Documents, as each have or shall be amended from time to time, shall include all of the revisions to each such document as provided for in this Sixth Amendment.

(d) Section IV (Additional Reporting and Other Requirements) is hereby amended by restating paragraph (J) in its entirely, to read as follows:

"(J) In addition to the other requirements of this Section IV, with respect to each Eligible CFC Loan, the Company shall and/or cause CFC to (i) deposit all CFC Collateral with a CFC Approved Depository, which CFC Approved Depository shall execute and deliver to the Agent a Depository Agreement, provided, that all CFC Collateral valued at $1,000,000 or more shall be stored at an Approved Depository, (ii) insure all CFC Collateral in amounts and coverage acceptable to the Lenders, which insurance policy shall name the Agent on behalf of the Lenders, as loss payee, (iii) comply with all of the terms and conditions of each CFC Assignment, Company Assignment, CFC Loan Assignment and each CFC Loan Document, (iv) deliver to the Agent, a UCC search with respect to each CFC Borrower indicating there are no liens or security interests covering the CFC Collateral of such CFC Borrower except in favor of CFC, the Company or the Agent, together with a copy of the UCC-l Financing Statement filed by CFC with respect to each CFC Borrower, (v) not make any CFC Loan which together with then outstanding Eligible CFC Loans would in the aggregate exceed the lesser of (A) the principal amount of $25,000,000 or (B) 25% of the Total Collateral Value as calculated and reported on the Company's most recent Collateral Report delivered to the Lenders, (vi) deliver to the Agent and the Lenders at the time of the delivery of each Collateral Report a supplement thereto (in form acceptable to the Agent and the Lenders) with respect to the CFC Collateral and CFC Loans in the form of Exhibit 2 annexed hereto, (vii) not make any CFC Loan which by its original terms is payable more than 6 months after its original execution date, (viii) not renew or extend any CFC Note evidencing a CFC Loan for more than 6 months, (ix) from time to time, at Agent's request, make such revisions to the CFC Loan Documents as the Agent or any Lender shall reasonably request, and (x) execute and deliver to the Agent a copy of each original CFC Note together with the applicable original executed CFC Allonge within two (2) Business Days after the execution of each CFC Note."

(e) Section IV is hereby further amended by adding a new paragraph (K) which shall read as follows:

"(K) The Company shall not permit Assigned Material or CFC Collateral. stored at any Approved Depository at anyone time to exceed in the aggregate the limits provided for each Approved Depository as set forth in Schedule A annexed to Exhibit 1 (Approved Depositories), as amended from time to time by the Lenders."

(f) Section X(B) is hereby amended by (i) deleting all references to FCC, Fortis Bank Nederland and RZB Finance LLC and (ii) adding thereto the following:

|

|

BNP Paribas |

Deborah Whittle |

deborah.whittle@americas.bnpparibas.com |

Structured Finance |

Commodity Finance North America |

787 Seventh Avenue, NY 10019 |

Phone: 212-841-2887 |

Fax: 212-841-2536 |

|

ABN AMRO Bank N.V. Stacey V. Judd |

stacey.judd@abnamro.com

|

100 Park Avenue, 17th Floor |

New York, NY 10017 |

Phone: 917-284-6906 |

Fax: 917-284-6683 |

|

RB International Finance (USA) LLC |

Katrin Lange -Hornby |

Klange@usafinance.rbinternational.com |

Commodity Finance

|

1133 Sixth Avenue, 16th Floor |

New York, NY 10036 |

Phone: 212-845-8367 |

Fax: 212-944-6389 |

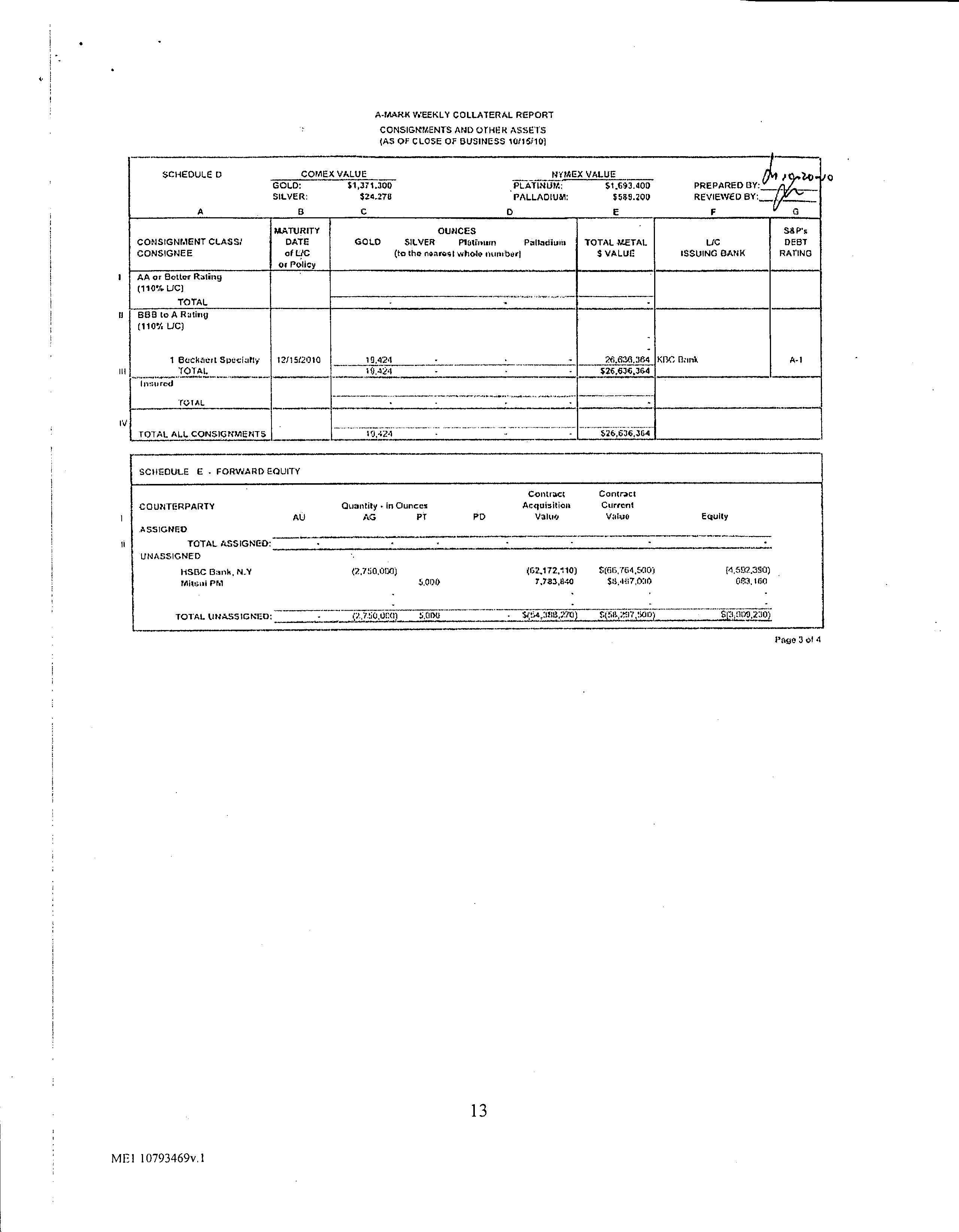

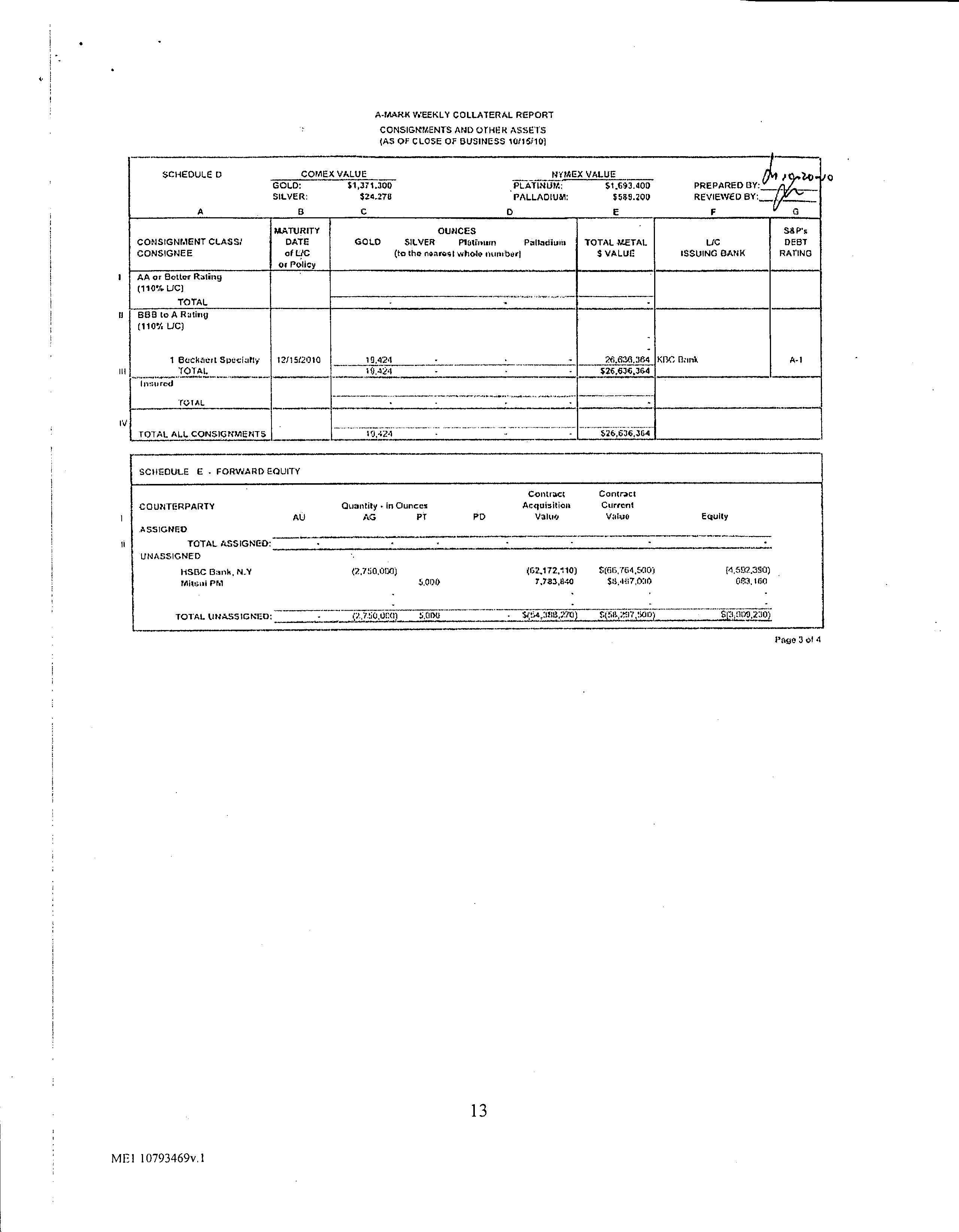

(g) Exhibit 2 (Collateral Report) is hereby amended to read in its entirety as set forth in Annex A to this Sixth Amendment.

(h) Notwithstanding anything to the contrary contained in the Agreement, as modified by this Sixth Amendment, CFC Collateral shall .not be included in Assigned Collateral and/or Confirmed Collateral but shall be treated as a separate category for purposes of computing Collateral Value on the Collateral Report.

(i) Exhibit 1 (Approved Depositories) is hereby amended to add thereto the Approved Depository limits as set forth in Annex B to this Sixth Amendment.

SECTION 2. AMENDMENTS TO FACILITY DOCUMENTS.

(a) Each reference to the term "Lenders" or any similar term in the Agreement, each Facility Document, the Security Agreement and the Intercreditor Agreement, shall be deemed a reference to the Lenders signatory to this Sixth Amendment. From and after the Effective Date ABN, BNP and RZB shall have all of the rights of and shall be subject to all of the obligations of a Lender under the Agreement, each Facility Document, the Security Agreement and the Intercreditor Agreement, as amended from time to time.

(b) Each reference in any Facility Document, the Security Agreement and the Intercreditor Agreement to the Collateral Agency Agreement, or words or terms of a similar meaning and the Exhibits relating thereto shall be deemed to incorporate the revisions provided for in this Sixth Amendment.

(c) The Agent hereby agrees to prepare and file all VCC Financing Statements or Amendments as reasonably requested by ABN, BNP or RZB to include it as a secured party in each filing heretofore made by the Agent on behalf of the Lenders.

SECTION 3. EFFECTIVE DATE.

The revisions contained in this Sixth Amendment to the Agreement, each Facility Document, the Security Agreement and the Intercreditor Agreement shall become effective (the "Effective Date") upon the execution and delivery by the parties hereto of this Sixth Amendment.

SECTION 4. FURTHER ASSURANCES.

The Company agrees to and cause others to execute and deliver all such documents as the Agent and/or the Lenders shall reasonably request in connection with the transactions contemplated by this Sixth Amendment.

SECTION 5. MISCELLANEOUS.

(a) The Company hereby represents and warrants that after giving effect to the transactions contemplated by this Sixth Amendment there exists no default under the Agreement, the Security Agreement or any Facility Document and the representations and warranties made by it herein and therein are materially true and correct as of the date hereof.

(b) In order to induce the Lenders and the Agent to enter into this Sixth Amendment, the Company hereby represents, warrants and covenants, that it has not granted nor shall after the Effective Date, grant a security interest in or assign any of its rights in any CFC Loan, any CFC Collateral, any CFC Note or any of the CFC Loan Documents to any other person, firm or entity (other than the Agent for the benefit of the Lenders and as provided in Section 5(i) below).

(c) Except as expressly modified by this Sixth Amendment, the Agreement, the Intercreditor Agreement, the Security Agreement and each Facility Document is, and shall remain, in full force and effect in accordance with its respective terms. Nothing herein shall be deemed to be a waiver by the Lenders or the Agent of any default by the Company or to be a waiver or modification by the Lenders or the Agent of any provision of the Agreement or any Facility Document except for the amendments expressly set forth in this Sixth Amendment.

(d) This Sixth Amendment may be executed in any number of separate counterparts, each of which shall be an original and all of which taken together shall be deemed to constitute one and the same instrument.

(e) This Sixth Amendment and the rights and obligations of the parties hereunder shall be governed by, and construed and interpreted in accordance with, the internal laws of the State of New York, without regard to conflict of laws principles.

(f) The Company hereby acknowledges and agrees that the Agreement, the Security Agreement and the Facility Documents as each are amended by this Sixth Amendment are each valid, binding and enforceable in accordance with their respective terms and provisions, and there are no counterclaims, defenses or offsets which may be asserted with respect thereto, or which may in any manner affect the collection or collectibility

of any of the Outstanding Credits or any of the principal, interest and other sums evidenced and secured thereby, nor is there any basis whatsoever for any such counterclaim, defense or offset.

(g) The Company agrees to pay or reimburse the Agent for all of the Agent's reasonable out-of-pocket costs and expenses incurred in connection with the development, preparation and execution of this Sixth Amendment and the documents herein contemplated, including, without limitation, the disbursements and fees of counsel to the Agent.

(h) This Sixth Amendment shall not be modified or amended except by a written instrument signed by all of the parties hereto and shall be binding on the respective successors and assigns of the parties.

IN WITNESS WHEREOF, the parties hereto have caused this Sixth Amendment to be duly executed and delivered by their proper and duly authorized officers as of the date and year first above written.

|

| |

A-MARK PRECIOUS METALS, INC. |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

BNP PARIBAS, as Lender |

| |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

| |

[SIGNATURES CONTINUED ON NEXT PAGE]

IN WITNESS WHEREOF, the parties hereto have caused this Sixth Amendment to be duly executed and delivered by their proper and duly authorized officers as of the date and year first above written.

|

| |

A-MARK PRECIOUS METALS, INC. |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

BNP PARIBAS, as Lender |

| |

By: | |

Name: | Deborah P. Whittle |

Title: | Director |

| |

By: | |

Name: | Christina Elio Roberts |

Title: | Managing Director |

| |

| |

[SIGNATURES CONTINUED ON NEXT PAGE]

|

| |

NATIXIS, NEW YORK BRANCH, as Lender |

By: | |

Name: | Carla Sweet |

Title: | Director |

| |

By: | |

Name: | |

Title: | Amaury COURTIAL |

| |

RB INTERNATIONAL FINANCE (USA) LLC, as Lender |

| |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

| |

[SIGNATURES CONTINUED ON NEXT PAGE]

|

| |

NATIXIS, NEW YORK BRANCH, as Lender |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

RB INTERNATIONAL FINANCE (USA) LLC, as Lender |

| |

By: | |

Name: | PEARL GEFFERS |

Title: | FIRST VICE PRESIDENT |

| |

By: | |

Name: | Katrin Lange-Hornby |

Title: | Vice President |

| |

| |

[SIGNATURES CONTINUED ON NEXT PAGE]

|

| |

ABN AMRO BANK N.V., as Lender |

By: | |

Name: | P.H.L.M Ingen Housz |

Title: | |

| |

By: | |

Name: | J.G. Cregten |

Title: | |

| |

BROWN BROTHERS HARRIMAN & CO., as Lender and Agent |

| |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

| |

|

| |

ABN AMRO BANK N.V., as Lender |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

BROWN BROTHERS HARRIMAN & CO., as Lender and Agent |

| |

By: | |

Name: | JOHN C. LORENZ |

Title: | SENIOR VICE PRESIDENT |

| |

ANNEXA

EXHIBIT 2

COLLATERAL REPORT

(INCLUDING CFC COLLATERAL)

[SEE ATTACHED]

ANNEX B

SCHEDULE A

TO EXHIBIT 1

APPROVED DEPOSITORY LIMITS

[ANNEXED HERETO]

EXECUTION COPY

A-MARK PRECIOUS METALS, INC.

SIXTH AMENDMENT DATED AS OF OCTOBER 29, 2010 TO

AMENDED AND RESTATED COLLATERAL AGENCY AGREEMENT (1999),

AMENDED AND RESTATED INTERCREDITOR AGREEMENT (1999), AND

AMENDED AND RESTATED GENERAL SECURITY AGREEMENT (1999)

EACH DATED AS OF NOVEMBER 30,1999,

AND EACH AS AMENDED

THIS SIXTH AMENDMENT is dated as of October 29, 2010 by and among BNP PARIBAS ("BNP") as successor to FORTIS CAPITAL CORP., ("FCC"), RB INTERNATIONAL (USA) LLC, f/k/a RZB FINANCE LLC ("RZB"), NATIXIS, NEW YORK BRANCH ("NATIXIS"), ABN AMRO Bank N.V. ("ABN") as successor to FORTIS BANK (NEDERLAND) N.V. ("FORTIS BANK NEDERLAND") and BROWN BROTHERS HARRIMAN & CO. ("BBH" in its capacity as agent for itself as a Lender (as defined below) and all other Lenders the "Agent") and A-MARK PRECIOUS METALS, INC., a New York corporation (the "Company"). BNP, RZB, NATIXIS, ABN and BBH are hereinafter sometimes referred to collectively as the "Lenders".

RECITALS

A. The Company, the Lenders and the Agent are parties to one or more of the: (i) Amended and Restated Collateral Agency Agreement (1999) dated as of November 30, 1999 (the "Agreement"); (ii) Amended and Restated Intercreditor Agreement (1999) dated as of November 30, 1999 (the "Intercreditor Agreement"); and (iii) Amended and Restated General Security Agreement (1999) dated as of November 30, 1999 (the "Security Agreement"), as each has been amended by amendments dated as of August 21, 2002, November 30, 2003, November 30, 2004, March 29, 2006 and March 31, 2010. The capitalized terms used in this Sixth Amendment shall have the meaning given each such term in the Agreement, as amended unless

otherwise defined herein.

B. By virtue of a statutory merger under Dutch law, ABN is the successor in interest to all of the rights and obligations of Fortis Bank Nederland, including, without limitation, all of its rights and obligations under the Facility Documents. Accordingly, since July 1,2010, the date of the merger of Fortis Bank Nederland into ABN, ABN became a Lender, and a party to the Agreement and the other Facility Documents, as amended.

C. FCC has transferred to BNP all of its rights and obligations under the Facility Documents and BNP has become a Lender and a party to the Agreement and the other Facility Documents as amended.

D. Pursuant to the provisions of the Fourth Amendment dated as of March 29, 2006, each of the Existing Lenders agreed to consider in its sole discretion to make advances to the Company, which were to be readvanced to Collateral Finance Corporation ("CFC"), a wholly owned subsidiary of the Company, for the purpose of enabling CFC to engage in the business of making loans to its borrowers secured by bullion and/or numismatically valuable or rare coins, which loans and collateral are to be assigned by CFC to the Company and by the Company to the Agent for the benefit of the Lenders,

E. The Company has requested that the Lenders consider in their respective sole discretion to continue to make advances to the Company which are to be readvanced to CFC, for the purpose described in Recital D above. The

Lenders have agreed to consider in their respective sole discretion to do so, on the terms and conditions set forth in the Facility Documents as amended by this Sixth Amendment and their respective loan documents.

F. The Company, the Lenders and the Agent, desire to amend the Agreement, the Facility Documents and the Exhibits and the Schedules annexed to the Agreement to: (i) revise the method of calculating: Collateral Value, (ii) confirm each of ABN and BNP as a Lender, and (iii) provide for changes in the CFC Loan Documents and for other additional changes, all on the terms and conditions provided for herein.

G. The foregoing Recitals are incorporated and made a part of this Sixth Amendment and the Agreement.

NOW, THEREFORE, the parties hereby agree as follows:

SECTION 1. AMENDMENTS TO THE AGREEMENT.

The Agreement is hereby amended as follows:

(a) Section I "Definitions" is hereby amended to add in alphabetical order or modify the following terms:

"Eligible CFC Loan" shall mean each CFC Loan as to which the Agent has received a duly executed CFC Loan Assignment and Company Assignment and the related CFC Loan Documents, in form, scope and substance, from time to time, acceptable to the Agent and the Lenders, which shall have been certified by an officer of CFC and the Company as being true and complete copies and is otherwise acceptable to the Agent, provided, in no event shall a CFC

Loan be deemed eligible, if (a) it together with all other outstanding CFC Loans to the same CFC Borrower are in excess of $5,000,000, or (b) the aggregate amount outstanding under all CFC Loans as at the date of computation shall be in excess of $25,000,000 unless the Agent, on behalf of and with the consent of all the Lenders, shall in writing approve an amount in excess of $25,000,000, or (c) the CFC Loan is secured by non-Bullion Collateral and the aggregate amount of all CFC Loans secured by non-Bullion Collateral (after giving effect to such proposed loan) is more than $18,750,000, or (d) a CFC Loan secured by Bullion Collateral is more than 95% of the Appraisal Value of such Bullion Collateral, or (e) a CFC Loan secured by Numismatic Collateral is more than 75% of the Appraisal Value of such Numismatic Collateral, or (f) a CFC Loan secured by Semi-Numismatic Collateral is more than 85% of the Appraisal Value of such Semi-Numismatic Collateral, or (g) the CFC Loan is not in compliance with any of the laws and regulations of the State of California, including, but not limited to those pertaining to usury and the licensing of CFC as a licensed lender, or (h) the term of the CFC Loan is more than six (6) months, or (i) CFC has granted a lien on any of its rights under such CFC Loan or the CFC Loan Documents to any person other than the Company or the Agent, or (j) any material provision of any CFC Loan Document is not valid, binding and enforceable, on and against the CFC Borrower; or the Agent's security interest in the CFC Collateral or the CFC Loan Documents is not a valid and perfected first priority security interest in favor of the Agent; or the CFC Borrower or CFC shall have any defense, setoff or other claim or right to reduce the amount payable under the CFC Loan Documents or CFC's obligations to the Company or any payment default or bankruptcy default shall have occurred with respect to the CFC Borrower or CFC, or (k) the CFC Collateral for such CFC Loan is not held at a CFC Approved Depository, or any other Approved Depository as shall be applicable, which has executed a Depository Agreement under which the Agent shall have the right to take exclusive control over such CFC Collateral, or (1) the Company and CFC have failed to comply with all of the terms and conditions contained in Section IV (J) hereof."

(b) Section II(C)(2) (Other Components of Collateral Value) is hereby amended by restating paragraph (k) in its entirety, to read as follows:

"(k) an amount equal to (i) 70% of the aggregate principal amount of the then outstanding Eligible CFC Loans secured by CFC Collateral (other than Bullion Collateral), plus (ii) 80% of the aggregate principal amount of the then outstanding Eligible CFC Loans secured by Bullion Collateral;"

(c) The terms "this Agreement", "Intercreditor Agreement" and "Security Agreement", and terms of similar import, as each is used in the Agreement, the Intercreditor Agreement, the Security Agreement and the other Facility Documents, as each have or shall be amended from time to time, shall include all of the revisions to each such document as provided for in this Sixth Amendment.

(d) Section IV (Additional Reporting and Other Requirements) is hereby amended by restating paragraph (J) in its entirely, to read as follows:

"(J) In addition to the other requirements of this Section IV, with respect to each Eligible CFC Loan, the Company shall and/or cause CFC to (i) deposit all CFC Collateral with a CFC Approved Depository, which CFC Approved Depository shall execute and deliver to the Agent a Depository Agreement, provided, that all CFC Collateral valued at $1,000,000 or more shall be stored at an Approved Depository, (ii) insure all CFC Collateral in amounts and coverage acceptable to the Lenders, which insurance policy shall name the Agent on behalf of the Lenders, as loss payee, (iii) comply with all of the terms and conditions of each CFC Assignment, Company Assignment, CFC Loan Assignment and each CFC Loan Document, (iv) deliver to the Agent, a UCC search with respect to each CFC Borrower indicating there are no liens or security interests covering the CFC Collateral of such CFC Borrower except in favor of CFC, the Company or the Agent, together with a copy of the UCC-l Financing Statement filed by CFC with respect to each CFC Borrower, (v) not make any CFC Loan which together with then outstanding Eligible CFC Loans would in the aggregate exceed the lesser of (A) the principal amount of $25,000,000 or (B) 25% of the Total Collateral Value as calculated and reported on the Company's most recent Collateral Report delivered to the Lenders, (vi) deliver to the Agent and the Lenders at the time of the delivery of each Collateral Report a supplement thereto (in form acceptable to the Agent and the Lenders) with respect to the CFC Collateral and CFC Loans in the form of Exhibit 2 annexed hereto, (vii) not make any CFC Loan which by its original terms is payable more than 6 months after its original execution date, (viii) not renew or extend any CFC Note evidencing a CFC Loan for more than 6 months, (ix) from time to time, at Agent's request, make such revisions to the CFC Loan Documents as the Agent or any Lender shall reasonably request, and (x) execute and deliver to the Agent a copy of each original CFC Note together with the applicable original executed CFC Allonge within two (2) Business Days after the execution of each CFC Note."

(e) Section IV is hereby further amended by adding a new paragraph (K) which shall read as follows:

"(K) The Company shall not permit Assigned Material or CFC Collateral. stored at any Approved Depository at anyone time to exceed in the aggregate the limits provided for each Approved Depository as set forth in Schedule A annexed to Exhibit 1 (Approved Depositories), as amended from time to time by the Lenders."

(f) Section X(B) is hereby amended by (i) deleting all references to FCC, Fortis Bank Nederland and RZB Finance LLC and (ii) adding thereto the following:

(g) Exhibit 2 (Collateral Report) is hereby amended to read in its entirety as set forth in Annex A to this Sixth Amendment.

|

|

BNP Paribas |

Deborah Whittle |

deborah.whittle@americas.bnpparibas.com |

Structured Finance |

Commodity Finance North America |

787 Seventh Avenue, NY 10019 |

Phone: 212-841-2887 |

Fax: 212-841-2536 |

|

ABN AMRO Bank N.V. Stacey V. Judd |

stacey.judd@abnamro.com

|

100 Park Avenue, 17th Floor |

New York, NY 10017 |

Phone: 917-284-6906 |

Fax: 917-284-6683 |

|

RB International Finance (USA) LLC |

Katrin Lange -Hornby |

Klange@usafinance.rbinternational.com |

Commodity Finance

|

1133 Sixth Avenue, 16th Floor |

New York, NY 10036 |

Phone: 212-845-8367 |

Fax: 212-944-6389 |

(h) Notwithstanding anything to the contrary contained in the Agreement, as modified by this Sixth Amendment, CFC Collateral shall .not be included in Assigned Collateral and/or Confirmed Collateral but shall be treated as a separate category for purposes of computing Collateral Value on the Collateral Report.

(i) Exhibit 1 (Approved Depositories) is hereby amended to add thereto the Approved Depository limits as set forth in Annex B to this Sixth Amendment.

SECTION 2. AMENDMENTS TO FACILITY DOCUMENTS.

(a) Each reference to the term "Lenders" or any similar term in the Agreement, each Facility Document, the Security Agreement and the Intercreditor Agreement, shall be deemed a reference to the Lenders signatory to this Sixth Amendment. From and after the Effective Date ABN, BNP and RZB shall have all of the rights of and shall be subject to all of the obligations of a Lender under the Agreement, each Facility Document, the Security Agreement and the Intercreditor Agreement, as amended from time to time.

(b) Each reference in any Facility Document, the Security Agreement and the Intercreditor Agreement to the Collateral Agency Agreement, or words or terms of a similar meaning and the Exhibits relating thereto shall be deemed to incorporate the revisions provided for in this Sixth Amendment.

(c) The Agent hereby agrees to prepare and file all VCC Financing Statements or Amendments as reasonably requested by ABN, BNP or RZB to include it as a secured party in each filing heretofore made by the Agent on behalf of the Lenders.

SECTION 3. EFFECTIVE DATE.

The revisions contained in this Sixth Amendment to the Agreement, each Facility Document, the Security Agreement and the Intercreditor Agreement shall become effective (the "Effective Date") upon the execution and delivery by the parties hereto of this Sixth Amendment.

SECTION 4. FURTHER ASSURANCES.

The Company agrees to and cause others to execute and deliver all such documents as the Agent and/or the Lenders shall reasonably request in connection with the transactions contemplated by this Sixth Amendment.

SECTION 5. MISCELLANEOUS.

(a) The Company hereby represents and warrants that after giving effect to the transactions contemplated by this Sixth Amendment there exists no default under the Agreement, the Security Agreement or any Facility Document and the representations and warranties made by it herein and therein are materially true and correct as of the date hereof.

(b) In order to induce the Lenders and the Agent to enter into this Sixth Amendment, the Company hereby represents, warrants and covenants, that it has not granted nor shall after the Effective Date, grant a security interest in or assign any of its rights in any CFC Loan, any CFC Collateral, any CFC Note or any of the CFC Loan Documents to any other person, firm or entity (other than the Agent for the benefit of the Lenders and as provided in Section 5(i) below).

(c) Except as expressly modified by this Sixth Amendment, the Agreement, the Intercreditor Agreement, the Security Agreement and each Facility Document is, and shall remain, in full force and effect in accordance with its respective terms. Nothing herein shall be deemed to be a waiver by the Lenders or the Agent of any default by the Company or to be a waiver or modification by the Lenders or the Agent of any provision of the Agreement or any Facility Document except for the amendments expressly set forth in this Sixth Amendment.

(d) This Sixth Amendment may be executed in any number of separate counterparts, each of which shall be an original and all of which taken together shall be deemed to constitute one and the same instrument.

(e) This Sixth Amendment and the rights and obligations of the parties hereunder shall be governed by, and construed and interpreted in accordance with, the internal laws of the State of New York, without regard to conflict of laws principles.

(f) The Company hereby acknowledges and agrees that the Agreement, the Security Agreement and the Facility Documents as each are amended by this Sixth Amendment are each valid, binding and enforceable in accordance with their respective terms and provisions, and there are no counterclaims, defenses or offsets which may be asserted with respect thereto, or which may in any manner affect the collection or collectibility

of any of the Outstanding Credits or any of the principal, interest and other sums evidenced and secured thereby, nor is there any basis whatsoever for any such counterclaim, defense or offset.

(g) The Company agrees to pay or reimburse the Agent for all of the Agent's reasonable out-of-pocket costs and expenses incurred in connection with the development, preparation and execution of this Sixth Amendment and the documents herein contemplated, including, without limitation, the disbursements and fees of counsel to the Agent.

(h) This Sixth Amendment shall not be modified or amended except by a written instrument signed by all of the parties hereto and shall be binding on the respective successors and assigns of the parties.

IN WITNESS WHEREOF, the parties hereto have caused this Sixth Amendment to be duly executed and delivered by their proper and duly authorized officers as of the date and year first above written.

|

| |

A-MARK PRECIOUS METALS, INC. |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

BNP PARIBAS, as Lender |

| |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

| |

[SIGNATURES CONTINUED ON NEXT PAGE]

IN WITNESS WHEREOF, the parties hereto have caused this Sixth Amendment to be duly executed and delivered by their proper and duly authorized officers as of the date and year first above written.

|

| |

A-MARK PRECIOUS METALS, INC. |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

BNP PARIBAS, as Lender |

| |

By: | |

Name: | Deborah P. Whittle |

Title: | Director |

| |

By: | |

Name: | Christina Elio Roberts |

Title: | Managing Director |

| |

| |

[SIGNATURES CONTINUED ON NEXT PAGE]

|

| |

NATIXIS, NEW YORK BRANCH, as Lender |

By: | |

Name: | Carla Sweet |

Title: | Director |

| |

By: | |

Name: | |

Title: | Amaury COURTIAL |

| |

RB INTERNATIONAL FINANCE (USA) LLC, as Lender |

| |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

| |

|

| |

NATIXIS, NEW YORK BRANCH, as Lender |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

RB INTERNATIONAL FINANCE (USA) LLC, as Lender |

| |

By: | |

Name: | PEARL GEFFERS |

Title: | FIRST VICE PRESIDENT |

| |

By: | |

Name: | Katrin Lange-Hornby |

Title: | Vice President |

| |

| |

[SIGNATURES CONTINUED ON NEXT PAGE]

|

| |

ABN AMRO BANK N.V., as Lender |

By: | |

Name: | P.H.L.M Ingen Housz |

Title: | |

| |

By: | |

Name: | J.G. Cregten |

Title: | |

| |

BROWN BROTHERS HARRIMAN & CO., as Lender and Agent |

| |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

| |

[SIGNATURES CONTINUED ON NEXT PAGE]

|

| |

ABN AMRO BANK N.V., as Lender |

By: | |

Name: | |

Title: | |

| |

By: | |

Name: | |

Title: | |

| |

BROWN BROTHERS HARRIMAN & CO., as Lender and Agent |

| |

By: | |

Name: | JOHN C. LORENZ |

Title: | SENIOR VICE PRESIDENT |

| |

ANNEXA

EXHIBIT 2

COLLATERAL REPORT

(INCLUDING CFC COLLATERAL)

[SEE ATTACHED]

ANNEX B

SCHEDULE A

TO EXHIBIT 1

APPROVED DEPOSITORY LIMITS

[ANNEXED HERETO]